Expansion of Retail Channels

The canned vegetables market is expanding retail channels, facilitating greater accessibility for consumers. Traditional grocery stores are increasingly complemented by online platforms and specialty retailers, allowing consumers to purchase canned vegetables with ease. Recent statistics indicate that online grocery sales in the US have surged by over 30% in the past year, reflecting a shift in shopping habits. This expansion is likely to enhance the visibility of canned vegetable products, making them more readily available to a wider audience. As a result, manufacturers in the canned vegetables market may invest in marketing strategies that target both online and offline consumers, potentially leading to increased market penetration and sales.

Innovations in Packaging Technology

The canned vegetables market is innovating in packaging technology, enhancing product appeal and shelf life. Advances in packaging materials and techniques are allowing manufacturers to improve the freshness and quality of canned vegetables. For instance, vacuum sealing and BPA-free cans are becoming more prevalent, addressing consumer concerns regarding food safety and environmental impact. This focus on innovative packaging is likely to attract health-conscious consumers who prioritize quality and sustainability. As a result, the canned vegetables market may experience growth as brands leverage these advancements to differentiate their products and meet evolving consumer preferences.

Rising Demand for Convenience Foods

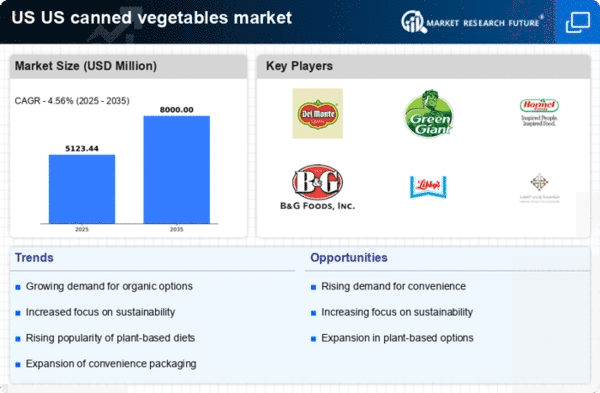

The canned vegetables market is notably increasing demand for convenience foods. Busy lifestyles and the need for quick meal solutions are driving consumers towards ready-to-eat options. According to recent data, approximately 60% of households in the US prioritize convenience when selecting food products. This trend is particularly evident among working professionals and families seeking products that require minimal preparation. Canned vegetables, with their long shelf life and ease of use, align perfectly with this consumer preference. As a result, manufacturers in the canned vegetables market are likely to innovate and expand their product lines to cater to this growing demand for convenience, potentially leading to increased sales and market share.

Increased Focus on Nutritional Value

The canned vegetables market is shifting towards products that offer enhanced nutritional benefits. Consumers are becoming more health-conscious, seeking foods that contribute positively to their diets. Data indicates that around 70% of consumers in the US are actively looking for products that are low in sodium and high in vitamins and minerals. This trend is prompting manufacturers to reformulate their canned vegetable offerings, ensuring they meet these health standards. Additionally, the rise of plant-based diets is influencing the market, as more individuals incorporate vegetables into their meals. Consequently, the canned vegetables market is likely to see a surge in demand for products that emphasize nutritional value, which could lead to increased competition among brands.

Growing Popularity of Plant-Based Diets

The canned vegetables market is benefiting from growing popularity of plant-based diets among consumers. As more individuals adopt vegetarian or vegan lifestyles, the demand for vegetable-based products is on the rise. Recent surveys suggest that nearly 30% of the US population is actively reducing meat consumption, which in turn boosts the appeal of canned vegetables as a versatile ingredient. This trend is encouraging manufacturers to diversify their product offerings, introducing new flavors and combinations that cater to plant-based consumers. The canned vegetables market is likely to capitalize on this trend, potentially leading to increased sales and a broader consumer base as more people seek convenient and nutritious plant-based options.