Enhanced Regulatory Frameworks

The evolving regulatory frameworks in the US are shaping the landscape of the biopharmaceuticals Market. Regulatory agencies, such as the Food and Drug Administration (FDA), are streamlining approval processes for innovative therapies, thereby expediting patient access to new treatments. Recent initiatives aimed at fostering innovation, such as the Breakthrough Therapy designation, are encouraging companies to invest in the development of novel biopharmaceuticals. This regulatory support is crucial, as it not only enhances the speed of bringing products to market but also ensures that safety and efficacy standards are maintained. As these frameworks continue to evolve, they are likely to create a more favorable environment for growth in the biopharmaceuticals Market.

Rising Prevalence of Chronic Diseases

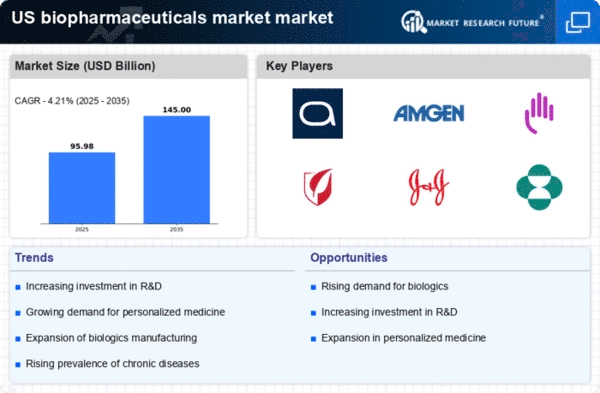

The increasing incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a significant driver for the biopharmaceuticals Market. According to the Centers for Disease Control and Prevention (CDC), chronic diseases account for 7 out of 10 deaths in the US, highlighting the urgent need for effective treatment options. This growing patient population is propelling demand for innovative biopharmaceutical products, which are often more effective than traditional therapies. As a result, the market is expected to expand, with estimates suggesting a growth rate of approximately 8% annually over the next few years. This trend underscores the critical role that biopharmaceuticals play in addressing public health challenges.

Investment in Research and Development

Investment in research and development (R&D) is a crucial driver of the biopharmaceuticals Market. Pharmaceutical companies are increasingly allocating substantial resources to R&D to discover and develop new therapies. In 2025, it is anticipated that R&D spending in the biopharmaceutical sector will exceed $200 billion, reflecting a commitment to innovation. This investment is essential for advancing the understanding of complex diseases and developing targeted therapies. Moreover, collaborations between academic institutions and industry players are fostering a conducive environment for breakthroughs in biopharmaceuticals. As R&D efforts intensify, the market is likely to witness a wave of new product launches, further stimulating growth.

Technological Advancements in Biopharmaceuticals

The biopharmaceuticals Market is experiencing a surge in technological advancements, particularly in areas such as gene therapy and monoclonal antibodies. These innovations are enhancing the efficacy and safety of treatments, leading to improved patient outcomes. For instance, the market for monoclonal antibodies alone is projected to reach approximately $150 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 10%. Furthermore, advancements in biomanufacturing processes are reducing production costs and time, thereby increasing accessibility to novel therapies. As these technologies continue to evolve, they are likely to drive growth in the biopharmaceuticals Market, attracting investments and fostering competition among key players.

Aging Population and Increased Healthcare Expenditure

The aging population in the US is a significant factor influencing the biopharmaceuticals Market. As individuals age, they are more susceptible to various health conditions, leading to increased demand for biopharmaceutical interventions. The US Census Bureau projects that by 2030, approximately 20% of the population will be 65 years or older, which will likely escalate healthcare expenditures. In 2025, healthcare spending is expected to reach around $4 trillion, with a substantial portion directed towards biopharmaceuticals. This demographic shift presents both challenges and opportunities for the market, as companies strive to develop therapies that cater to the unique needs of older adults.