Growing Focus on Rare Diseases

There is a growing focus on rare diseases within the biopharmaceuticals market in the UK, which is shaping the landscape of drug development. With an estimated 7,000 rare diseases affecting millions of individuals, the demand for targeted therapies is increasing. Biopharmaceutical companies are recognizing the potential for lucrative markets in developing treatments for these conditions, often referred to as orphan drugs. The UK government has implemented incentives to encourage the development of therapies for rare diseases, including tax credits and grants. This supportive environment is likely to stimulate innovation and investment in the biopharmaceuticals market, as companies seek to address the unmet needs of patients suffering from rare conditions.

Increasing Demand for Advanced Therapies

The biopharmaceuticals market in the UK is experiencing a notable surge in demand for advanced therapies, particularly those that leverage innovative biotechnological methods. This trend is driven by a growing patient population with chronic diseases and genetic disorders, which necessitates more effective treatment options. The market for advanced therapies is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust expansion. As healthcare providers increasingly adopt these therapies, the biopharmaceuticals market is likely to witness significant growth, with investments in research and development reaching new heights. This demand is further fueled by the increasing awareness among patients regarding treatment options, leading to a more informed consumer base that actively seeks out advanced therapies.

Collaboration Between Academia and Industry

The biopharmaceuticals market is benefiting from an increasing trend of collaboration between academic institutions and industry players in the UK. These partnerships are fostering innovation by combining academic research capabilities with industry expertise and resources. Collaborative initiatives often lead to the development of groundbreaking therapies and technologies, which can significantly enhance the product pipeline of biopharmaceutical companies. Furthermore, such collaborations may facilitate access to funding and resources, enabling faster progression from research to market. As the landscape of biopharmaceuticals continues to evolve, these partnerships are likely to play a pivotal role in driving advancements and ensuring that the market remains dynamic and responsive to emerging healthcare needs.

Regulatory Support for Biopharmaceutical Innovations

Regulatory bodies in the UK are actively fostering an environment conducive to innovation within the biopharmaceuticals market. Initiatives aimed at streamlining the approval process for new biopharmaceutical products are becoming more prevalent, which may enhance the speed at which novel therapies reach the market. The Medicines and Healthcare products Regulatory Agency (MHRA) has introduced frameworks that encourage the development of cutting-edge treatments, particularly in areas such as gene therapy and monoclonal antibodies. This regulatory support is crucial, as it not only reduces the time and cost associated with bringing new products to market but also instills confidence among investors. Consequently, the biopharmaceuticals market is likely to benefit from an influx of innovative products, potentially leading to a more competitive landscape.

Investment in Biopharmaceutical Research and Development

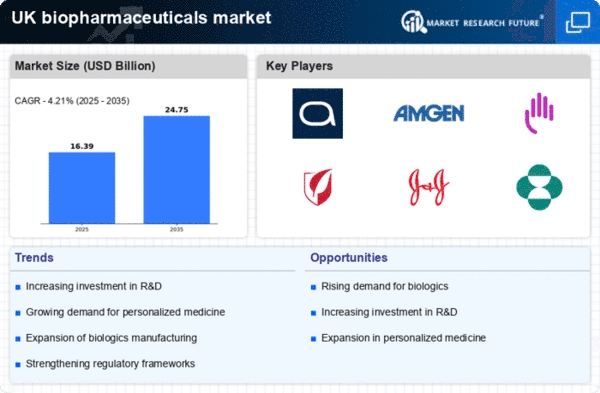

Investment in research and development (R&D) within the biopharmaceuticals market is witnessing a significant uptick in the UK. Pharmaceutical companies are allocating substantial resources to R&D, with expenditures reaching approximately £2.5 billion annually. This investment is primarily directed towards the development of novel therapeutics and biologics, which are increasingly seen as the future of medicine. The focus on R&D is driven by the need to address unmet medical needs and the potential for high returns on investment. As companies strive to innovate and differentiate their product offerings, the biopharmaceuticals market is expected to expand, with a growing number of new therapies entering the market. This trend underscores the importance of sustained investment in R&D to maintain a competitive edge.