Growing Focus on Cost Efficiency

The Biopharmaceuticals Contract Manufacturing Market is increasingly driven by a growing focus on cost efficiency among biopharmaceutical companies. As the industry faces pressure to reduce drug development costs and improve profitability, many companies are turning to contract manufacturers to leverage their expertise and economies of scale. By outsourcing production, biopharmaceutical firms can minimize capital expenditures and operational risks associated with maintaining in-house manufacturing facilities. This trend is particularly evident in the production of complex biologics, where specialized knowledge and infrastructure are essential. As cost pressures continue to mount, the reliance on contract manufacturing is expected to rise, further propelling the industry forward.

Regulatory Support and Compliance

The Biopharmaceuticals Contract Manufacturing Market is bolstered by increasing regulatory support and compliance frameworks that facilitate the development and production of biopharmaceuticals. Regulatory bodies are streamlining approval processes and providing clearer guidelines, which encourages investment in contract manufacturing capabilities. This supportive environment is crucial for manufacturers aiming to navigate the complex regulatory landscape associated with biopharmaceutical products. As regulations evolve, contract manufacturers must remain agile and compliant, ensuring that they can meet the stringent quality and safety standards required in the industry. This regulatory clarity is likely to enhance the attractiveness of contract manufacturing partnerships.

Advancements in Manufacturing Technologies

The Biopharmaceuticals Contract Manufacturing Market is significantly influenced by advancements in manufacturing technologies. Innovations such as continuous manufacturing, single-use technologies, and automation are transforming production processes, enhancing efficiency, and reducing costs. These technologies allow for faster turnaround times and improved product quality, which are critical in meeting the growing demand for biopharmaceuticals. The integration of digital solutions, including data analytics and artificial intelligence, is also streamlining operations and enabling manufacturers to optimize their processes. As these technologies continue to evolve, they are expected to play a pivotal role in shaping the future landscape of the biopharmaceuticals contract manufacturing sector.

Increasing Demand for Personalized Medicine

The Biopharmaceuticals Contract Manufacturing Market is experiencing a notable surge in demand for personalized medicine. This trend is driven by advancements in genomics and biotechnology, which enable the development of tailored therapies that cater to individual patient needs. As healthcare systems increasingly prioritize personalized treatment approaches, contract manufacturers are adapting their capabilities to meet these specific requirements. The market for personalized medicine is projected to reach substantial figures, with estimates suggesting it could exceed USD 2 trillion by 2025. This shift towards individualized therapies necessitates a flexible and responsive manufacturing environment, positioning contract manufacturers as essential partners in the biopharmaceutical supply chain.

Expansion of Biopharmaceuticals in Emerging Markets

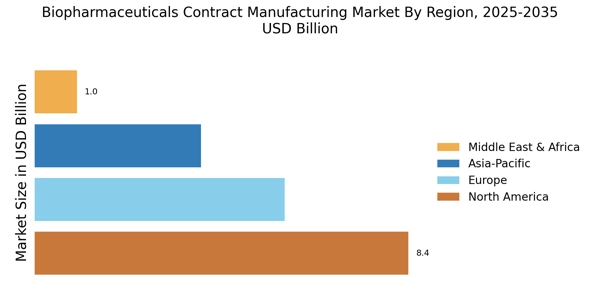

The Biopharmaceuticals Contract Manufacturing Market is witnessing significant growth in emerging markets, where increasing healthcare investments and rising patient populations are driving demand for biopharmaceutical products. Countries in Asia-Pacific and Latin America are particularly notable for their expanding biopharmaceutical sectors. The market in these regions is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2025. This expansion presents opportunities for contract manufacturers to establish local facilities, thereby reducing costs and improving supply chain efficiency. As these markets continue to develop, the need for reliable contract manufacturing services will likely increase, further bolstering the industry.