Investment in Infrastructure Development

Investment in infrastructure development is a crucial driver for the automotive off-highway-engine market. The US government has committed substantial funding towards infrastructure projects, including roads, bridges, and public transportation systems. This investment is anticipated to create a robust demand for off-highway vehicles, particularly in construction and maintenance applications. In 2025, federal spending on infrastructure is projected to exceed $200 billion, which will likely stimulate growth in the automotive off-highway-engine market. As construction companies ramp up their operations to meet these demands, the market is expected to see a corresponding increase in engine sales and innovations.

Technological Integration and Automation

Technological integration and automation are pivotal drivers in the automotive off-highway-engine market. The adoption of advanced technologies, such as telematics and automation, is transforming how off-highway vehicles operate. These technologies enhance efficiency, reduce operational costs, and improve safety. For instance, telematics systems allow for real-time monitoring of engine performance, leading to proactive maintenance and reduced downtime. The market is witnessing a shift towards smart machinery, which is expected to account for over 30% of the total off-highway equipment market by 2026. This trend indicates a significant opportunity for manufacturers to innovate and differentiate their offerings in the automotive off-highway-engine market.

Regulatory Compliance and Emission Standards

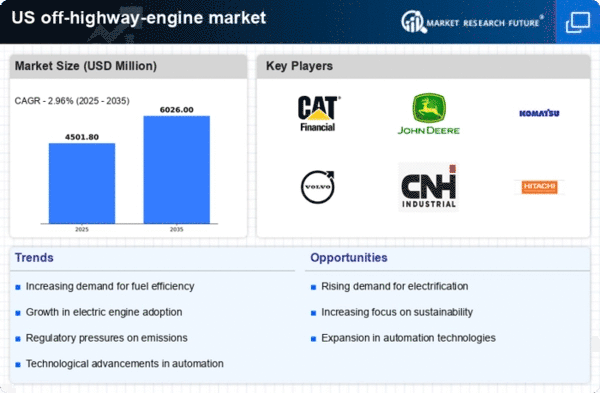

The automotive off-highway-engine market is increasingly influenced by stringent regulatory compliance and emission standards set by government agencies. In the US, the Environmental Protection Agency (EPA) has established regulations that require manufacturers to reduce emissions from off-highway engines. This has led to a shift towards cleaner technologies, such as diesel engines with advanced after-treatment systems. As a result, companies are investing heavily in research and development to meet these standards, which is expected to drive market growth. The market is projected to reach approximately $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5%. Compliance with these regulations not only enhances environmental sustainability but also positions manufacturers favorably in the competitive landscape of the automotive off-highway-engine market.

Shift Towards Fuel Efficiency and Cost Reduction

The automotive off-highway-engine market is witnessing a shift towards fuel efficiency and cost reduction as key drivers. Manufacturers are increasingly focusing on developing engines that offer better fuel economy while maintaining performance. This trend is largely influenced by rising fuel prices and the need for operational cost savings among end-users. In 2025, it is estimated that fuel-efficient engines could reduce operational costs by up to 15%, making them more attractive to fleet operators. As a result, the automotive off-highway-engine market is likely to see a growing preference for engines that combine efficiency with power, thereby enhancing competitiveness in the market.

Rising Demand for Construction and Agricultural Equipment

The automotive off-highway-engine market is experiencing a surge in demand driven by the construction and agricultural sectors. As infrastructure projects expand and agricultural activities increase, the need for robust off-highway vehicles is becoming more pronounced. In 2025, the construction industry in the US is expected to grow by 4%, leading to a higher demand for construction equipment powered by off-highway engines. Similarly, advancements in agricultural technology are prompting farmers to invest in modern machinery, further propelling the market. This growing demand is likely to result in a market valuation exceeding $12 billion by 2027, indicating a strong trajectory for the automotive off-highway-engine market.