Global Supply Chain Resilience

The US Automotive Logistics Market is currently navigating challenges related to global supply chain resilience. Recent disruptions in international trade and logistics have underscored the importance of building robust supply chains that can withstand unforeseen events. As manufacturers seek to mitigate risks, there is a growing emphasis on diversifying supply sources and enhancing domestic production capabilities. This shift is likely to lead to increased investment in local logistics infrastructure, which could bolster the US economy. According to estimates, enhancing supply chain resilience could reduce logistics costs by up to 15% in the long term. Furthermore, logistics providers are exploring partnerships and collaborations to strengthen their networks, ensuring they can respond effectively to market fluctuations. As the industry adapts to these dynamics, the focus on resilience will play a pivotal role in shaping the future of the US Automotive Logistics Market.

Regulatory Compliance and Standards

The US Automotive Logistics Market is significantly influenced by regulatory compliance and standards that govern transportation and logistics operations. The Federal Motor Carrier Safety Administration (FMCSA) and the Environmental Protection Agency (EPA) impose regulations that logistics companies must adhere to, impacting operational practices. Compliance with these regulations ensures safety and environmental sustainability, which are increasingly prioritized by consumers and stakeholders. For example, the implementation of the Electronic Logging Device (ELD) mandate has transformed how trucking operations are managed, enhancing accountability and efficiency. Additionally, adherence to emissions standards is pushing logistics providers to invest in cleaner technologies, which may incur initial costs but could lead to long-term savings and improved public perception. As regulations evolve, the ability to navigate these complexities will be crucial for success in the US Automotive Logistics Market.

Growing Demand for Electric Vehicles

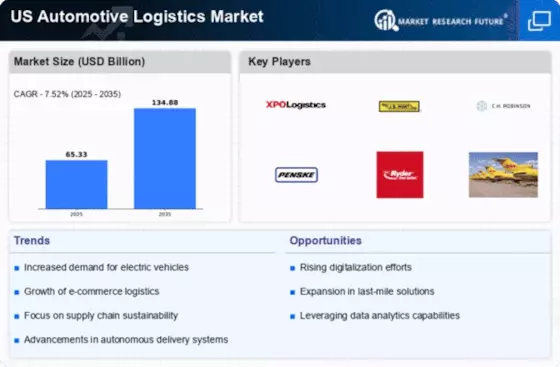

The US Automotive Logistics Market is witnessing a surge in demand for electric vehicles (EVs), which is reshaping logistics strategies. As manufacturers ramp up production to meet consumer preferences for sustainable transportation, logistics providers must adapt to the unique requirements of EV supply chains. This includes specialized handling and transportation of batteries and components, which necessitates new logistics solutions. According to industry forecasts, the EV market is expected to grow at a compound annual growth rate (CAGR) of over 20% through 2030, indicating a substantial shift in automotive logistics. Consequently, logistics companies are investing in training and infrastructure to support this transition, ensuring they can efficiently manage the complexities associated with EV logistics. This growing demand not only presents challenges but also opportunities for innovation within the US Automotive Logistics Market.

Technological Advancements in Logistics

The US Automotive Logistics Market is experiencing a transformative phase driven by technological advancements. Innovations such as artificial intelligence, machine learning, and blockchain are enhancing supply chain efficiency and transparency. For instance, AI algorithms optimize routing and inventory management, reducing costs and delivery times. According to recent data, the integration of these technologies could potentially increase operational efficiency by up to 30%. Furthermore, the adoption of automated vehicles and drones for last-mile delivery is gaining traction, indicating a shift towards more innovative logistics solutions. This technological evolution not only streamlines operations but also improves customer satisfaction, as timely deliveries become more achievable. As the industry continues to embrace these advancements, the competitive landscape is likely to evolve, compelling logistics providers to adapt and innovate continuously.

E-commerce and Direct-to-Consumer Trends

The US Automotive Logistics Market is increasingly influenced by the rise of e-commerce and direct-to-consumer sales models. As consumers demand greater convenience and faster delivery options, automotive logistics providers are compelled to adapt their strategies accordingly. The shift towards online vehicle sales and parts distribution is prompting logistics companies to enhance their last-mile delivery capabilities. Data indicates that e-commerce sales in the automotive sector are projected to reach $100 billion by 2025, highlighting the need for efficient logistics solutions. This trend necessitates the development of agile supply chains that can respond quickly to consumer demands while maintaining cost-effectiveness. As logistics providers embrace these changes, they are likely to invest in technology and infrastructure that facilitate seamless integration between online platforms and logistics operations, thereby enhancing overall customer experience in the US Automotive Logistics Market.