Increased Air Travel Demand

The airport passenger-screening-systems market is poised for growth due to the rising demand for air travel in the US. As more individuals opt for air travel, the volume of passengers requiring screening increases, necessitating the expansion and enhancement of screening systems. According to the Federal Aviation Administration (FAA), passenger numbers are expected to reach over 1 billion annually by 2030. This surge in air travel creates a pressing need for efficient and effective screening solutions, thereby propelling the airport passenger-screening-systems market forward.

Focus on Enhanced Passenger Experience

The airport passenger-screening-systems market is increasingly focusing on enhancing the passenger experience. Airports are recognizing the importance of minimizing inconvenience during the screening process, which can lead to improved customer satisfaction. Innovations such as expedited screening programs and user-friendly interfaces are being integrated into screening systems. This shift not only addresses passenger concerns but also encourages repeat travel. As a result, investments in systems that prioritize user experience are likely to rise, further stimulating growth in the airport passenger-screening-systems market.

Emerging Threats and Security Challenges

The airport passenger screening systems market is driven by emerging threats and security challenges. As security risks evolve, airports must adapt their screening technologies to counteract potential threats effectively. This includes the development of systems capable of detecting new types of contraband and explosives. The market is likely to see increased investment in research and development to create advanced screening solutions that can respond to these challenges. Consequently, the airport passenger-screening-systems market is expected to expand as airports strive to maintain high security standards.

Regulatory Compliance and Security Standards

The airport passenger-screening-systems market is significantly influenced by stringent regulatory compliance and evolving security standards set by government agencies such as the Transportation Security Administration (TSA). These regulations mandate the implementation of advanced screening technologies to ensure passenger safety. As a result, airports are compelled to invest in state-of-the-art screening systems that meet these requirements. The financial implications are notable, with airports potentially allocating millions of dollars to upgrade their systems. This ongoing need for compliance drives the demand for innovative solutions within the airport passenger-screening-systems market.

Technological Advancements in Screening Equipment

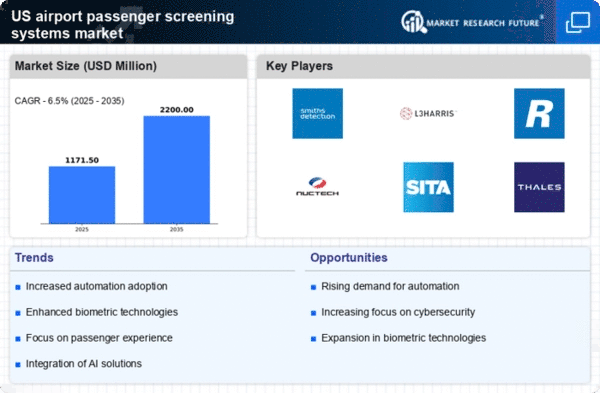

The airport passenger-screening-systems market is experiencing a surge in technological advancements, particularly in the development of high-resolution imaging systems and automated screening lanes. These innovations enhance the efficiency and accuracy of security checks, thereby reducing wait times for passengers. For instance, the introduction of computed tomography (CT) scanners has improved the detection of prohibited items, leading to a more secure travel environment. The market is projected to grow at a CAGR of approximately 7% over the next five years, driven by the need for enhanced security measures and the adoption of advanced technologies in airports across the US.