Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver in the Airport IT Systems Market. Technologies such as artificial intelligence, machine learning, and the Internet of Things are being increasingly utilized to enhance airport operations. These technologies enable predictive analytics, which can improve decision-making processes and operational efficiency. For instance, AI-driven systems can analyze passenger flow and optimize staffing levels accordingly. The market for AI in airport operations is projected to grow significantly, indicating a strong trend towards technological integration. This shift not only enhances operational capabilities but also improves the overall passenger experience, making it a crucial factor for airports aiming to remain competitive.

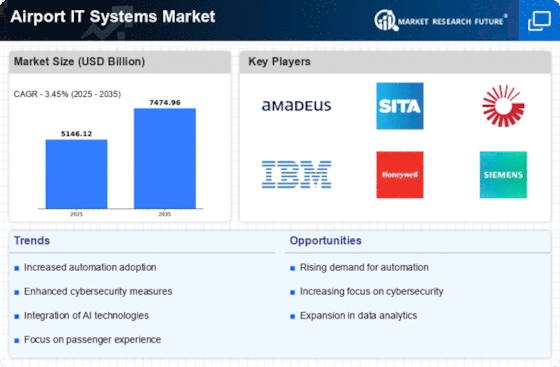

Growing Demand for Efficient Operations

The Airport IT Systems Market is experiencing a surge in demand for efficient operational solutions. Airports are increasingly adopting IT systems to streamline processes, reduce delays, and enhance passenger experiences. According to recent data, the implementation of advanced IT solutions can lead to a reduction in operational costs by up to 20%. This trend is driven by the need for airports to manage increasing passenger volumes while maintaining high service standards. As a result, investments in IT systems that facilitate real-time data sharing and operational efficiency are becoming a priority for airport authorities. The focus on improving operational efficiency is likely to continue, as airports seek to leverage technology to optimize resource allocation and enhance overall performance.

Focus on Passenger Experience Enhancement

Enhancing passenger experience is a significant driver in the Airport IT Systems Market. Airports are increasingly recognizing the importance of providing seamless and enjoyable travel experiences. IT systems that facilitate real-time information sharing, mobile check-ins, and personalized services are becoming essential. Data indicates that airports investing in passenger experience technologies can see a notable increase in customer satisfaction ratings. This focus on passenger-centric solutions is likely to drive further investments in IT systems that cater to the evolving needs of travelers. As competition among airports intensifies, the ability to offer superior passenger experiences through innovative IT solutions will be a key differentiator.

Regulatory Compliance and Safety Standards

Regulatory compliance and adherence to safety standards are critical drivers in the Airport IT Systems Market. Airports are mandated to comply with various international and national regulations, which necessitate the implementation of robust IT systems. These systems are essential for ensuring safety, security, and efficient operations. The increasing complexity of regulatory requirements is pushing airports to invest in IT solutions that can facilitate compliance monitoring and reporting. Moreover, the emphasis on safety has led to the adoption of advanced surveillance and monitoring systems, which are integral to maintaining operational integrity. As regulations evolve, the demand for IT systems that can adapt to these changes is likely to grow.

Sustainability Initiatives and Green Technologies

Sustainability initiatives are emerging as a vital driver in the Airport IT Systems Market. Airports are increasingly adopting green technologies and sustainable practices to minimize their environmental impact. IT systems that support energy management, waste reduction, and resource optimization are gaining traction. The implementation of such systems not only aligns with global sustainability goals but also enhances operational efficiency. Data suggests that airports that invest in sustainable IT solutions can achieve significant cost savings over time. As environmental concerns continue to rise, the integration of sustainability-focused IT systems is likely to become a standard practice in airport operations, influencing future investments.