Regulatory Mandates

Regulatory mandates play a crucial role in shaping the airport baggage-screening-systems market. Government agencies, such as the Transportation Security Administration (TSA), impose stringent regulations to ensure the safety of air travel. Compliance with these regulations necessitates the adoption of advanced screening technologies by airports. As a result, the market is witnessing a surge in demand for systems that meet or exceed regulatory standards. The financial implications are significant, with airports investing millions in upgrading their screening infrastructure. This trend is expected to continue, as regulatory bodies are likely to introduce even more rigorous requirements in the coming years. Consequently, the airport baggage-screening-systems market is poised for growth as airports strive to comply with evolving regulations.

Passenger Volume Growth

The airport baggage-screening-systems market is significantly influenced by the growth in passenger volumes across the United States. As air travel continues to rise, airports are faced with the challenge of efficiently screening an increasing number of bags. This surge in passenger traffic necessitates the expansion and modernization of baggage screening systems to maintain operational efficiency and security. Recent statistics indicate that passenger numbers are expected to increase by 4% annually over the next few years. This growth presents a substantial opportunity for manufacturers of baggage screening systems to innovate and provide solutions that can handle higher volumes without compromising security. Thus, the airport baggage-screening-systems market is likely to expand in response to this upward trend in air travel.

Technological Integration

The integration of cutting-edge technologies is a key driver in the airport baggage-screening-systems market. Innovations such as artificial intelligence (AI), machine learning, and advanced imaging techniques are transforming traditional screening processes. These technologies enhance the accuracy and speed of baggage inspections, thereby improving overall airport efficiency. For instance, AI-driven systems can analyze baggage contents in real-time, significantly reducing false alarms and manual interventions. The market is expected to witness a substantial increase in the adoption of these technologies, with estimates suggesting a growth rate of approximately 8% annually. This trend indicates a shift towards more automated and intelligent screening solutions, which are essential for meeting the evolving demands of airport security.

Increasing Security Concerns

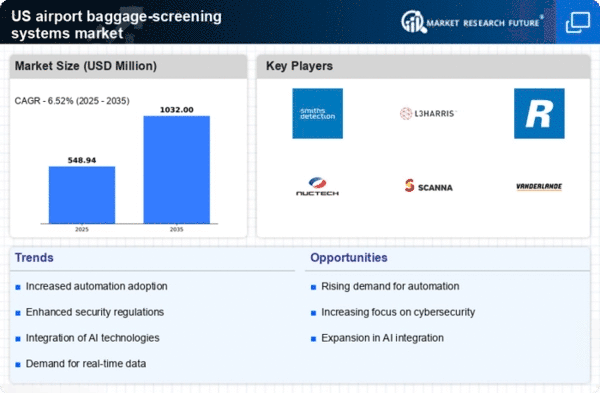

The market is experiencing growth driven by heightened security concerns in the aviation sector. With the rise in global terrorism and criminal activities, airports are compelled to enhance their security measures. This has led to increased investments in advanced baggage screening technologies. According to recent data, the market is projected to grow at a CAGR of 7.5% over the next five years, reflecting the urgency for improved security protocols. Airports are prioritizing the implementation of sophisticated screening systems to ensure passenger safety and maintain operational integrity. As a result, the demand for innovative solutions in the airport baggage-screening-systems market is likely to rise, prompting manufacturers to develop more effective and efficient technologies.

Investment in Infrastructure

Investment in airport infrastructure is a significant driver of the airport baggage-screening-systems market. As airports modernize and expand their facilities, there is a corresponding need for advanced baggage screening technologies. This investment is often fueled by public-private partnerships and government funding aimed at enhancing airport security and efficiency. Recent reports suggest that airport authorities are allocating substantial budgets, with some airports planning to invest upwards of $500 million in infrastructure improvements over the next decade. This influx of capital is likely to stimulate demand for state-of-the-art baggage screening systems, as airports seek to implement solutions that can accommodate future growth and technological advancements. Consequently, the airport baggage-screening-systems market is expected to benefit from this trend.