Growth in Mobile Device Market

The proliferation of mobile devices is a key driver for the 3d nand-memory market. With the increasing reliance on smartphones, tablets, and wearables, the demand for high-capacity and fast memory solutions is on the rise. In 2025, the mobile device segment is expected to account for over 30% of the total memory market, highlighting the critical role of 3d nand-memory technology in meeting these needs. The compact design and enhanced performance of 3d nand-memory make it an ideal choice for manufacturers aiming to deliver cutting-edge mobile devices. As consumer preferences shift towards devices with greater storage capabilities, the 3d nand-memory market is likely to see substantial growth, driven by innovations in mobile technology.

Increased Focus on Data Security

As data breaches and cyber threats become more prevalent, the emphasis on data security is driving the 3d nand-memory market. Organizations are increasingly investing in secure memory solutions to protect sensitive information. The 3d nand-memory technology offers enhanced security features, making it a preferred choice for sectors such as finance, healthcare, and government. In 2025, the market for secure memory solutions is expected to expand, with the 3d nand-memory market playing a pivotal role in this transformation. The integration of encryption and advanced security protocols within memory solutions is likely to attract more businesses seeking to safeguard their data, thereby boosting the overall market.

Advancements in Automotive Technology

The automotive sector is increasingly integrating advanced technologies, which is positively impacting the 3d nand-memory market. With the rise of electric vehicles (EVs) and autonomous driving systems, the demand for reliable and high-capacity memory solutions is escalating. In 2025, it is estimated that the automotive industry will contribute significantly to the overall memory market, with a projected growth rate of around 10%. The 3d nand-memory market is well-positioned to cater to this demand, as it provides the necessary speed and durability required for automotive applications. As vehicles become more connected and data-driven, the reliance on advanced memory solutions will continue to grow, further solidifying the market's relevance.

Emergence of Cloud Computing Services

The rise of cloud computing services is significantly influencing the 3d nand-memory market. As businesses increasingly migrate to cloud-based solutions, the demand for efficient and scalable memory technologies is growing. The 3d nand-memory market is poised to benefit from this trend, as it provides the necessary performance and reliability for cloud storage applications. In 2025, the cloud computing segment is projected to account for a substantial share of the memory market, with a growth rate of approximately 12%. This shift towards cloud services necessitates advanced memory solutions that can handle vast amounts of data, thereby reinforcing the importance of 3d nand-memory technology in the evolving digital landscape.

Rising Demand for High-Performance Computing

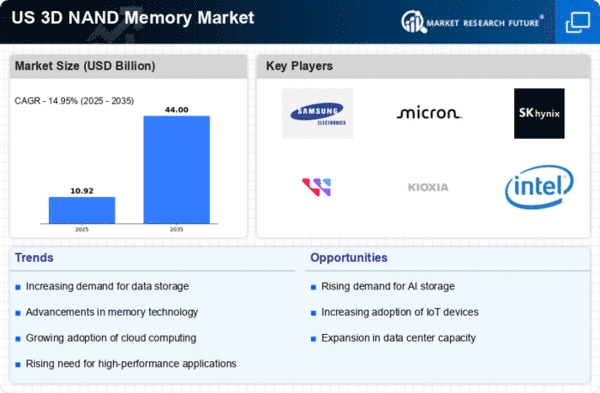

The 3d nand-memory market is experiencing a surge in demand driven by the increasing need for high-performance computing solutions. Industries such as artificial intelligence, machine learning, and big data analytics are pushing the boundaries of data processing capabilities. As organizations seek to enhance their computational power, the adoption of 3d nand-memory technology becomes crucial. This technology offers superior speed and efficiency, which are essential for handling large datasets. In 2025, the market is projected to grow at a CAGR of approximately 15%, reflecting the escalating requirements for advanced memory solutions. The 3d nand-memory market is thus positioned to benefit significantly from this trend, as it aligns with the technological advancements in computing and data management.