Emergence of 5G Technology

The emergence of 5G technology is poised to have a profound impact on the hybrid memory-cube-high-bandwidth-memory market. With the rollout of 5G networks, there is an increasing demand for high-speed data transmission and processing capabilities. This new generation of wireless technology is expected to facilitate the development of applications that require low latency and high bandwidth, such as augmented reality and IoT devices. The 5G infrastructure is projected to generate an economic impact of $13.2 trillion by 2035, which indicates a substantial opportunity for the hybrid memory-cube-high-bandwidth-memory market. As the demand for faster and more efficient memory solutions grows, the market is likely to expand in response to these technological advancements.

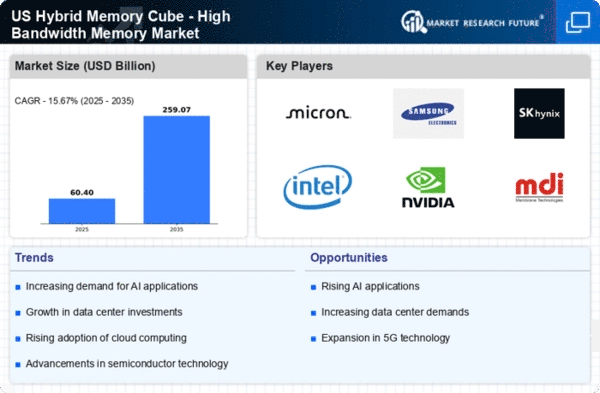

Surge in Data-Intensive Applications

The market is experiencing a surge in demand driven by the proliferation of data-intensive applications. Industries such as finance, healthcare, and telecommunications are increasingly relying on high-performance computing to process vast amounts of data. This trend is expected to propel the market, as organizations seek solutions that can handle complex computations efficiently. According to recent estimates, the market for high-performance computing is projected to reach $50 billion by 2026, indicating a robust growth trajectory. As data generation continues to escalate, the need for advanced memory solutions becomes paramount, positioning the hybrid memory-cube-high-bandwidth-memory market as a critical player in meeting these demands.

Increased Investment in Cloud Computing

The hybrid memory-cube-high-bandwidth-memory market is benefiting from increased investment in cloud computing infrastructure. As businesses migrate to cloud-based solutions, the demand for high-speed memory systems that can support large-scale data processing is rising. The cloud computing market in the US is expected to reach $500 billion by 2025, reflecting a growing reliance on cloud services. This shift necessitates the adoption of advanced memory technologies, such as hybrid memory cubes, to ensure optimal performance and efficiency. Consequently, the hybrid memory-cube-high-bandwidth-memory market is positioned to capitalize on this trend, as organizations seek to enhance their cloud capabilities.

Advancements in Semiconductor Technology

Advancements in semiconductor technology are significantly influencing the hybrid memory-cube-high-bandwidth-memory market. Innovations in chip design and manufacturing processes are enabling the development of faster and more efficient memory solutions. For instance, the introduction of 3D stacking technology allows for higher memory density and improved bandwidth, which are essential for modern computing applications. The semiconductor industry in the US is projected to grow at a CAGR of 5.5% through 2027, which suggests a favorable environment for the hybrid memory-cube-high-bandwidth-memory market. As technology continues to evolve, the integration of these advancements into memory solutions will likely enhance performance and drive market growth.

Growing Need for Real-Time Data Processing

The market is driven by the growing need for real-time data processing across various sectors. Industries such as automotive, finance, and healthcare are increasingly adopting technologies that require instantaneous data analysis and decision-making. This trend is particularly evident in applications like autonomous vehicles and financial trading systems, where delays can result in significant losses. The demand for memory solutions that can support these real-time applications is expected to rise, thereby bolstering the hybrid memory-cube-high-bandwidth-memory market. As organizations prioritize speed and efficiency, the market is likely to see substantial growth in the coming years.