Adoption of 5G Technology

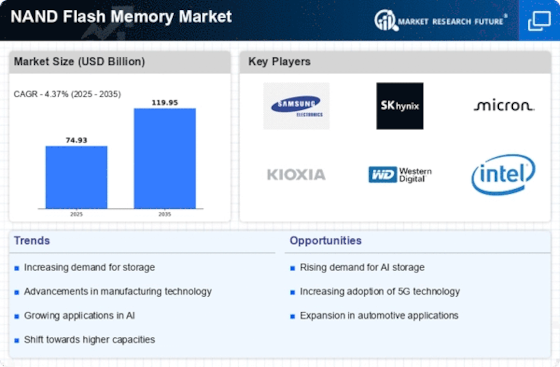

The adoption of 5G technology is poised to significantly impact the NAND Flash Memory Market. With the rollout of 5G networks, there is an expected increase in data transmission speeds and connectivity, which in turn drives the demand for advanced storage solutions. In 2025, it is projected that the integration of 5G in various sectors, including automotive, healthcare, and entertainment, will necessitate enhanced data storage capabilities. This could lead to a surge in NAND flash memory usage, as devices will require faster and more reliable storage to handle the increased data flow. Analysts suggest that the 5G revolution may contribute to a growth rate of around 15% in the NAND Flash Memory Market, highlighting the technology's potential to reshape the storage landscape.

Expansion of Data Centers

The expansion of data centers is a crucial factor influencing the NAND Flash Memory Market. As businesses increasingly migrate to cloud-based solutions, the demand for high-performance storage solutions has surged. In 2025, data centers are anticipated to require vast amounts of NAND flash memory to support the growing volume of data generated by enterprises. Reports indicate that the data center segment could represent over 30% of the NAND Flash Memory Market, driven by the need for faster data retrieval and processing capabilities. This trend suggests that companies are likely to prioritize NAND flash technology to enhance their operational efficiency and scalability. Additionally, the rise of big data analytics and artificial intelligence applications further emphasizes the necessity for robust storage solutions, positioning the NAND Flash Memory Market as a key player in the evolving data landscape.

Growth of Automotive Electronics

The growth of automotive electronics is becoming an increasingly important driver for the NAND Flash Memory Market. As vehicles become more technologically advanced, the integration of electronic systems for navigation, infotainment, and safety features is on the rise. By 2025, the automotive sector is expected to account for a notable share of the NAND Flash Memory Market, with estimates indicating a growth rate of approximately 12% annually. This trend suggests that automotive manufacturers are likely to invest in NAND flash memory to support the growing complexity of vehicle electronics. Furthermore, the shift towards electric vehicles and autonomous driving technologies is likely to further amplify the demand for high-capacity and reliable storage solutions, positioning the NAND Flash Memory Market at the forefront of automotive innovation.

Rising Demand for Consumer Electronics

The increasing demand for consumer electronics is a primary driver of the NAND Flash Memory Market. As smartphones, tablets, and laptops become ubiquitous, the need for efficient and high-capacity storage solutions intensifies. In 2025, the consumer electronics sector is projected to account for a substantial share of the NAND Flash Memory Market, with estimates suggesting a growth rate of approximately 10% annually. This trend indicates that manufacturers are likely to invest heavily in NAND technology to meet consumer expectations for speed and storage capacity. Furthermore, the proliferation of smart home devices and wearables is expected to further bolster demand, as these products increasingly rely on NAND flash for data storage and processing. Thus, the consumer electronics boom appears to be a significant catalyst for the NAND Flash Memory Market.

Emergence of Artificial Intelligence Applications

The emergence of artificial intelligence applications is a pivotal driver of the NAND Flash Memory Market. As AI technologies continue to evolve, the need for efficient data storage solutions becomes increasingly critical. In 2025, it is anticipated that AI applications will require substantial amounts of NAND flash memory to process and analyze vast datasets. This demand could lead to a significant increase in the market share of NAND flash memory, with projections suggesting a growth rate of around 14% in this segment. The integration of AI in various industries, including healthcare, finance, and manufacturing, underscores the necessity for high-performance storage solutions. Consequently, the NAND Flash Memory Market is likely to experience robust growth as it adapts to the storage needs of emerging AI technologies.