Growing Emphasis on Customer Experience

In the Unified Communication as a Service Market, there is a notable shift towards enhancing customer experience through improved communication strategies. Companies are increasingly recognizing the importance of effective communication in building strong customer relationships. The integration of unified communication solutions allows businesses to provide personalized and timely responses to customer inquiries, thereby enhancing satisfaction levels. Recent studies suggest that organizations utilizing unified communication tools report a 20% increase in customer satisfaction scores. This focus on customer experience is likely to drive further investments in unified communication technologies, as businesses strive to differentiate themselves in competitive markets. By leveraging advanced analytics and real-time communication capabilities, companies can better understand customer needs and preferences, ultimately leading to improved service delivery and loyalty.

Integration of Advanced Analytics and AI

The Unified Communication as a Service Market is witnessing a transformative shift with the integration of advanced analytics and artificial intelligence. Organizations are increasingly leveraging data-driven insights to enhance communication strategies and improve decision-making processes. The incorporation of AI technologies enables businesses to analyze communication patterns, identify trends, and optimize workflows. Recent findings suggest that companies utilizing AI-driven communication tools experience a 30% increase in operational efficiency. This trend indicates a growing recognition of the value of data in shaping communication practices. As organizations strive to remain competitive, the adoption of unified communication solutions that incorporate advanced analytics and AI capabilities is likely to accelerate. This integration not only enhances the effectiveness of communication but also empowers organizations to make informed decisions based on real-time data.

Regulatory Compliance and Security Concerns

In the Unified Communication as a Service Market, regulatory compliance and security concerns are becoming increasingly prominent. As organizations adopt unified communication solutions, they must navigate a complex landscape of regulations governing data protection and privacy. The need for secure communication channels is paramount, particularly in industries such as finance and healthcare, where sensitive information is exchanged. Recent surveys indicate that nearly 70% of businesses prioritize security features when selecting unified communication providers. This focus on compliance and security is likely to drive the demand for solutions that offer robust encryption and data protection measures. As organizations seek to mitigate risks associated with data breaches and ensure compliance with regulations, the adoption of secure unified communication services is expected to rise, further shaping the market landscape.

Advancements in Technology and Infrastructure

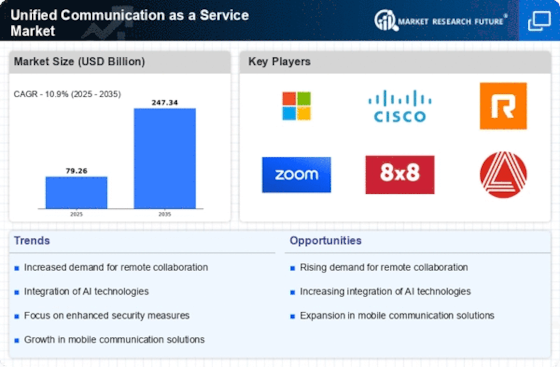

The Unified Communication as a Service Market is significantly influenced by advancements in technology and infrastructure. The proliferation of high-speed internet and the increasing availability of cloud computing resources have created a conducive environment for the adoption of unified communication solutions. As organizations upgrade their IT infrastructure, they are more inclined to invest in unified communication services that offer scalability and flexibility. Recent reports indicate that The Unified Communication as a Service is expected to reach USD 100 billion by 2026, reflecting the growing reliance on cloud-based solutions. This technological evolution not only enhances the functionality of communication tools but also reduces operational costs for businesses. As a result, organizations are more likely to embrace unified communication services as a strategic investment to improve collaboration and streamline operations.

Increased Demand for Remote Collaboration Tools

The Unified Communication as a Service Market experiences heightened demand for remote collaboration tools, driven by the ongoing evolution of work environments. Organizations are increasingly adopting cloud-based solutions to facilitate seamless communication among distributed teams. According to recent data, the market for remote collaboration tools is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This trend indicates a shift towards more flexible work arrangements, where employees can collaborate effectively regardless of their physical location. As businesses seek to enhance productivity and maintain operational efficiency, the adoption of unified communication solutions becomes paramount. The integration of various communication channels into a single platform not only streamlines workflows but also fosters a culture of collaboration, which is essential in today's fast-paced business landscape.