Focus on Enhanced Customer Experience

The unified communication-service market is increasingly shaped by the focus on enhancing customer experience across industries in the GCC. Businesses are recognizing that effective communication plays a pivotal role in customer satisfaction and retention. As a result, there is a growing emphasis on implementing communication solutions that facilitate better interaction with customers. Recent market analysis suggests that organizations investing in unified communication services can improve customer engagement metrics by up to 25%. This trend indicates a shift towards prioritizing customer-centric communication strategies, which in turn drives the demand for innovative solutions within the unified communication-service market.

Rising Mobile Workforce and BYOD Policies

The unified communication-service market is being propelled by the rise of the mobile workforce and the implementation of Bring Your Own Device (BYOD) policies in the GCC. As employees increasingly rely on mobile devices for work-related tasks, the need for communication solutions that support mobility is paramount. Recent surveys indicate that over 60% of organizations in the GCC have adopted BYOD policies, allowing employees to use personal devices for work purposes. This trend necessitates the development of secure and efficient communication services that can operate seamlessly across various platforms. Consequently, the unified communication-service market is likely to see a substantial increase in demand for mobile-friendly solutions that cater to the needs of a diverse workforce.

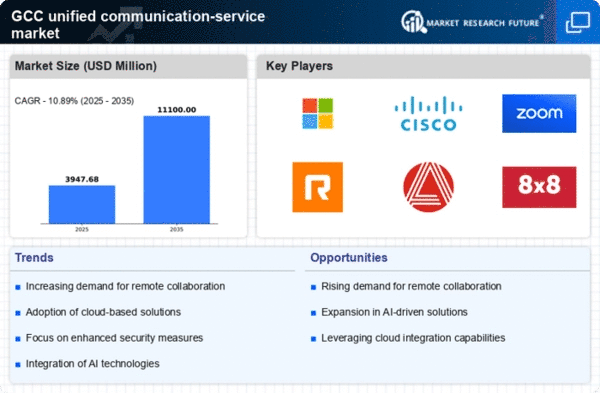

Growing Demand for Remote Collaboration Tools

The unified communication-service market is experiencing a notable surge in demand for remote collaboration tools. This trend is driven by the increasing number of organizations in the GCC adopting flexible work arrangements. As businesses seek to enhance productivity and maintain connectivity among remote teams, the market for solutions that facilitate seamless communication and collaboration is expanding. Recent data indicates that the GCC region has seen a growth rate of approximately 15% in the adoption of remote collaboration tools over the past year. This shift not only reflects changing work dynamics but also highlights the necessity for businesses to invest in robust communication solutions to remain competitive in the evolving landscape.

Regulatory Compliance and Data Protection Needs

The unified communication-service market is significantly impacted by the regulatory compliance and data protection needs of organizations operating in the GCC. With the introduction of stringent data protection laws, businesses are compelled to adopt communication solutions that ensure compliance while safeguarding sensitive information. Recent reports indicate that nearly 70% of companies in the region are prioritizing compliance with data protection regulations, which is likely to influence their choice of communication services. This heightened focus on regulatory adherence is expected to drive the demand for secure and compliant unified communication solutions, as organizations seek to mitigate risks associated with data breaches and non-compliance.

Investment in Digital Transformation Initiatives

The unified communication-service market is significantly influenced by the ongoing investment in digital transformation initiatives across various sectors in the GCC. Organizations are increasingly recognizing the importance of integrating advanced communication technologies to streamline operations and enhance customer engagement. According to recent statistics, the GCC region is projected to allocate over $10 billion towards digital transformation efforts in the next few years. This investment is likely to drive the demand for unified communication services, as businesses seek to leverage these technologies to improve efficiency and foster innovation. The alignment of communication strategies with digital transformation goals is becoming a critical focus for organizations aiming to thrive in a competitive environment.