Top Industry Leaders in the Underwater Acoustic Communication Market

The Competitive Landscape of the Underwater Acoustic Communication Market

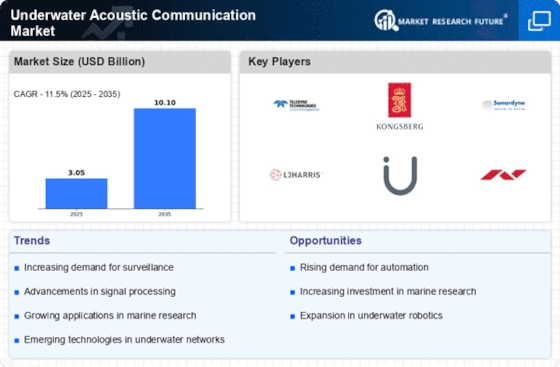

The underwater acoustic communication (UWAC) market is experiencing a surge in exploration and innovation. This growth can be attributed to diverse applications like defense, offshore energy, scientific research, and underwater internet, creating a dynamic competitive landscape teeming with established players and emerging disruptors.

Key Player:

- sea and land technologies pte ltd

- L3Harris Technologies, Inc.

- Kongsberg

- sonardyne international ltd

- EvoLogics GmbH

- Thales

- Undersea Systems International, Inc.

- Ultra Electronics Holdings plc

- Teledyne Marine

- Saab AB

Strategies Adopted by Key Players:

- Product Innovation: Leading players invest heavily in R&D to develop advanced UAC technologies, including higher bandwidths, longer ranges, and improved reliability. New entrants often focus on niche applications with specialized solutions.

- Strategic Acquisitions: Established players acquire smaller companies with complementary technologies or expertise to expand their product offerings and market reach. This inorganic growth strategy can accelerate market share acquisition.

- Partnerships and Collaborations: Collaboration between companies allows them to leverage each other's strengths and develop innovative solutions for specific applications. This can be particularly beneficial for new entrants seeking to gain market traction.

- Focus on Vertical Markets: Targeting specific industries with customized solutions allows companies to cater to unique needs and gain a competitive edge in those segments. This can be a successful strategy for both established and emerging players.

Factors Influencing Market Share Analysis

- Product Portfolio: The breadth and depth of a company's UAC product offerings significantly impact their market share. Offering solutions across various range, type, and application segments expands market reach.

- Technological Expertise: Companies with advanced R&D capabilities and expertise in acoustic communication technologies have a competitive advantage. This allows them to develop innovative solutions and stay ahead of the curve.

- Geographical Presence: A global reach allows companies to tap into diverse markets and cater to a wider customer base. Established players often have a wider geographical presence compared to new entrants.

- Customer Service and Support: Providing reliable customer service and support builds trust and loyalty, leading to repeat business and increased market share. This is particularly crucial in industries like defense and offshore operations.

- Pricing Strategy: Competitive pricing strategies can attract new customers and gain market share, especially in cost-sensitive sectors. However, balancing price with product quality and value proposition is essential.

New and Emerging Companies:

- Underwater IoT Startups: Companies like Sea-ID and Aquanaut are developing underwater sensor networks and communication solutions for aquaculture, environmental monitoring, and oceanographic research.

- Low-Power UAC Solutions: Companies like Sonardyne and iXblue are developing low-power UAC technologies for long-range underwater communication and data transmission, particularly for autonomous vehicles and remote monitoring applications.

- Software-Defined UAC: Companies like Liquid Instruments and Xylem are developing software-defined UAC platforms that offer flexibility, scalability, and adaptability to changing requirements.

Latest Company Updates:

L3Harris Technologies, Inc.

- January 2024: L3Harris announces the release of its VLA-5000 underwater acoustic modem, offering improved performance and reliability for long-range underwater communication. The VLA-5000 features advanced error correction and channel coding techniques to ensure reliable data transmission in challenging underwater environments.

- November 2023: L3Harris receives a contract from the U.S. Navy to supply AN/SQR-80 underwater acoustic communication systems for Virginia-class submarines. This contract supports the Navy's modernization efforts and strengthens submarine communications capabilities.

Additional Industry Developments:

- September 2023: The European Commission awards a €3 million grant to a consortium led by Thales Group to develop an underwater acoustic communication network for maritime surveillance in the Mediterranean Sea. This project aims to improve maritime safety and security by enabling real-time data exchange between vessels and authorities.

- July 2023: The U.S. Office of Naval Research (ONR) launches a new research program to investigate the use of artificial intelligence (AI) for underwater acoustic communication. This program seeks to develop AI-powered algorithms that can optimize UACU performance and enable more efficient and reliable underwater communication.