By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region has a rapidly growing automotive industry, and the increasing demand for advanced safety and security systems in the industry is driving the growth of the ultrasonic sensor market in the region. In addition, the growing demand for ultrasonic sensors in the industrial sector, for applications such as distance measurement and level measurement, is also contributing to the growth of the ultrasonic sensor market in the Asia-Pacific region.

The increasing demand for ultrasonic sensors in the food and beverage and pharmaceutical industries is also driving the growth of the ultrasonic sensor market in the region. Furthermore, the increasing investments in research and development activities for the development of advanced ultrasonic sensors and the growing demand for energy-efficient and eco-friendly products are also driving the growth of the ultrasonic sensor market in the Asia-Pacific region.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil

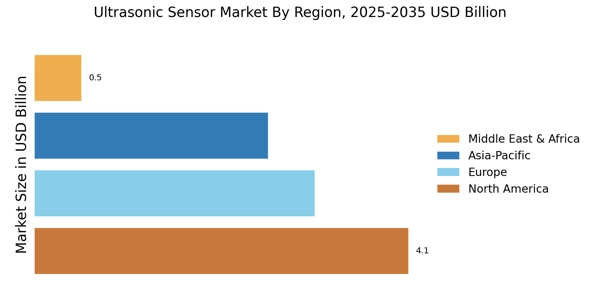

Europe’s Ultrasonic Sensor Market accounts for the third-largest market share. This is because there is a growing demand for ultrasonic sensors in various end-use industries in the region, such as automotive, aerospace, and industrial. Europe has a well-established automotive industry, and the increasing demand for advanced safety and security systems in the industry is driving the growth of the ultrasonic sensor market in the region.

Furthermore, the increasing investments in research and development activities for the development of advanced ultrasonic sensors and the growing demand for energy-efficient and eco-friendly products are also driving the growth of the ultrasonic sensor market in Europe. Further, the Germany Ultrasonic Sensor Market held the largest market share, and the UK Ultrasonic Sensor Market was the fastest-growing market in the European region.

North America is expected to hold the largest share of the Ultrasonic Sensor Market from 2023 to 2030. This can be attributed to the presence of major players in the region, the growing demand for ultrasonic sensors in various end-use industries, such as automotive, aerospace, and industrial, and the increasing investments in research and development activities for the development of advanced ultrasonic sensors.

In addition, the presence of well-established healthcare and food and beverage industries in the region is also driving the demand for ultrasonic sensors. The increasing demand for safety and security systems in the automotive and aerospace industries is also contributing to the growth of the ultrasonic sensor market in North America. Moreover, the U.S. Ultrasonic Sensor Market held the largest market share, and the Canada Ultrasonic Sensor Market was the fastest-growing market in the North American region.