Rising Demand for Safety Features

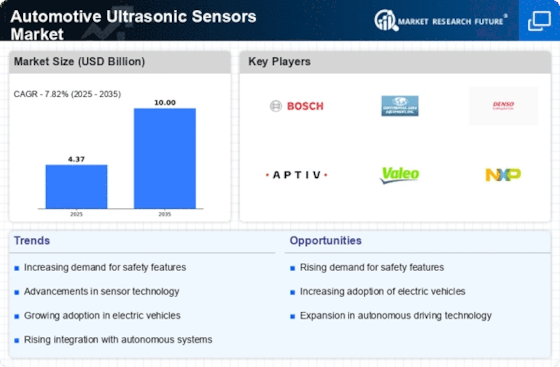

The Automotive Ultrasonic Sensors Market is experiencing a notable surge in demand for enhanced safety features in vehicles. As consumers increasingly prioritize safety, manufacturers are integrating ultrasonic sensors to facilitate advanced parking assistance, collision avoidance, and blind-spot detection systems. This trend is underscored by data indicating that vehicles equipped with such safety technologies have a higher market appeal, potentially leading to increased sales. The integration of ultrasonic sensors not only enhances vehicle safety but also aligns with regulatory requirements aimed at reducing road accidents. Consequently, this driver is likely to propel the growth of the Automotive Ultrasonic Sensors Market as automakers strive to meet consumer expectations and comply with safety standards.

Increasing Adoption of Electric Vehicles

The Automotive Ultrasonic Sensors Market is likely to benefit from the increasing adoption of electric vehicles (EVs). As the automotive landscape shifts towards electrification, manufacturers are incorporating ultrasonic sensors to enhance the functionality of EVs, particularly in areas such as parking assistance and proximity detection. The rise in EV sales, supported by government incentives and consumer interest in sustainable transportation, is expected to drive demand for advanced sensor technologies. Market analysis indicates that the integration of ultrasonic sensors in EVs not only improves safety but also contributes to the overall efficiency of these vehicles. This trend suggests a promising future for the Automotive Ultrasonic Sensors Market as it aligns with the broader movement towards electric mobility.

Consumer Preference for Smart Vehicle Features

Consumer preference for smart vehicle features is significantly shaping the Automotive Ultrasonic Sensors Market. As technology becomes more integrated into daily life, consumers are increasingly seeking vehicles equipped with intelligent features that enhance convenience and safety. Ultrasonic sensors play a pivotal role in enabling these smart functionalities, such as automated parking and real-time obstacle detection. Market data suggests that vehicles with advanced sensor systems are more appealing to tech-savvy consumers, potentially leading to higher sales figures. This growing demand for smart vehicle features is likely to drive innovation and investment in the Automotive Ultrasonic Sensors Market, as manufacturers aim to meet the expectations of a discerning customer base.

Technological Advancements in Sensor Technology

Technological advancements are significantly influencing the Automotive Ultrasonic Sensors Market. Innovations in sensor technology, such as improved signal processing algorithms and enhanced sensitivity, are enabling more accurate and reliable performance in various applications. These advancements facilitate the development of sophisticated features like automated parking and obstacle detection, which are becoming increasingly prevalent in modern vehicles. Market data suggests that the introduction of next-generation ultrasonic sensors could lead to a substantial increase in their adoption rates, as manufacturers seek to differentiate their offerings. As a result, the Automotive Ultrasonic Sensors Market is poised for growth driven by these technological enhancements, which promise to improve user experience and vehicle functionality.

Regulatory Support for Advanced Safety Technologies

Regulatory support for advanced safety technologies is a critical driver for the Automotive Ultrasonic Sensors Market. Governments worldwide are implementing stringent safety regulations that mandate the inclusion of advanced driver assistance systems (ADAS) in new vehicles. This regulatory landscape encourages manufacturers to adopt ultrasonic sensors as a means to comply with safety standards and enhance vehicle safety features. Data indicates that regions with stricter regulations are witnessing a faster adoption of ultrasonic sensor technologies, as automakers strive to meet compliance requirements. Consequently, this regulatory push is likely to stimulate growth in the Automotive Ultrasonic Sensors Market, as manufacturers invest in innovative sensor solutions to adhere to evolving safety mandates.

Leave a Comment