Expansion of Robotics and Automation

The ultrasonic sensor market is poised for growth due to the expansion of robotics and automation in various industries. As companies increasingly adopt automation to enhance efficiency and reduce operational costs, ultrasonic sensors are becoming essential components in robotic systems. These sensors facilitate precise distance measurement and object detection, enabling robots to navigate complex environments. The industrial robotics market in the US is expected to grow significantly, with a projected CAGR of around 12% from 2025 to 2030. This trend suggests that the ultrasonic sensor market will likely benefit from the rising demand for automated solutions, as manufacturers seek to integrate advanced sensing technologies into their robotic applications.

Growing Focus on Safety and Security

The ultrasonic sensor market is witnessing growth driven by an increasing focus on safety and security across various sectors. In industrial settings, ultrasonic sensors are utilized for collision avoidance and personnel detection, enhancing workplace safety. Similarly, in the automotive industry, these sensors are integral to advanced driver-assistance systems (ADAS), which aim to reduce accidents and improve road safety. The US government has implemented regulations mandating safety features in vehicles, which is likely to boost the demand for ultrasonic sensors. The market is projected to expand as organizations prioritize safety measures, indicating a robust future for the ultrasonic sensor market in the context of safety and security enhancements.

Increasing Adoption in Smart Home Devices

The ultrasonic sensor market is benefiting from the increasing adoption of smart home devices. As consumers seek enhanced convenience and security, manufacturers are integrating ultrasonic sensors into products such as smart alarms, automated lighting systems, and home security cameras. These sensors provide accurate distance measurement and motion detection, which are essential for the functionality of smart home applications. According to recent estimates, the smart home market in the US is expected to reach $100 billion by 2025, with ultrasonic sensors playing a crucial role in this growth. The demand for energy-efficient and user-friendly smart home solutions is likely to propel the ultrasonic sensor market further, as manufacturers strive to meet consumer expectations.

Technological Advancements in Sensing Technology

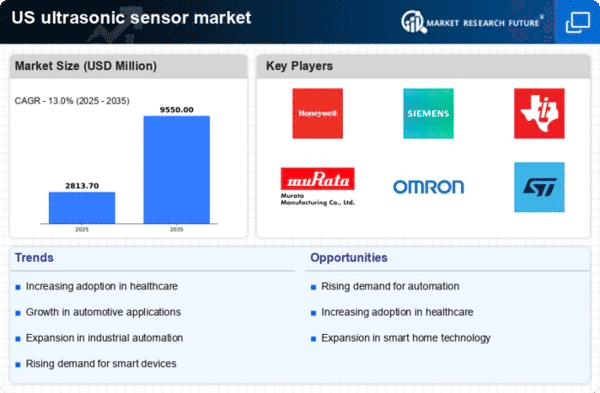

The ultrasonic sensor market is experiencing a surge due to rapid technological advancements in sensing technology. Innovations in microelectromechanical systems (MEMS) and signal processing algorithms enhance the performance and accuracy of ultrasonic sensors. These improvements enable applications across various sectors, including automotive, industrial, and healthcare. For instance, the integration of ultrasonic sensors in autonomous vehicles for obstacle detection and parking assistance is becoming increasingly prevalent. The market is projected to grow at a CAGR of approximately 10% from 2025 to 2030, driven by these technological enhancements. As companies invest in research and development, the ultrasonic sensor market is likely to witness a proliferation of new products and applications, further solidifying its position in the technology landscape.

Rising Demand for Non-Contact Measurement Solutions

The ultrasonic sensor market is experiencing a notable increase in demand for non-contact measurement solutions. Industries such as manufacturing, logistics, and healthcare are increasingly adopting ultrasonic sensors for applications that require precise distance measurement without physical contact. This trend is particularly relevant in scenarios where hygiene and safety are paramount, such as in medical equipment and food processing. The market for non-contact measurement solutions is projected to grow at a CAGR of approximately 9% over the next five years. As industries continue to prioritize efficiency and safety, the ultrasonic sensor market is likely to expand, driven by the growing preference for non-contact technologies.