Increasing Energy Security Needs

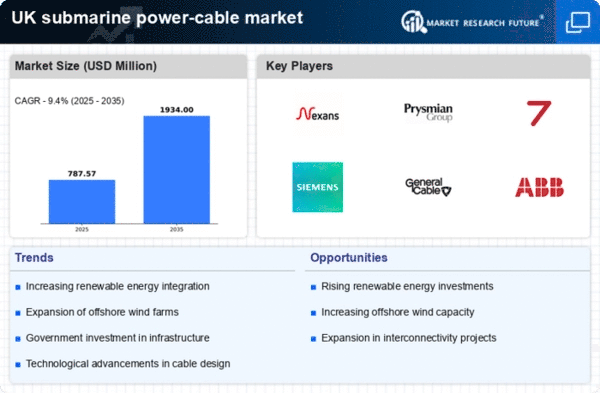

The submarine power-cable market is experiencing a notable surge due to the increasing energy security needs in the UK. As the nation seeks to diversify its energy sources, the reliance on renewable energy, particularly offshore wind farms, has become paramount. The UK government aims to generate 40 GW of offshore wind energy by 2030, which necessitates robust submarine power-cable infrastructure. This infrastructure is essential for transmitting electricity from remote wind farms to the mainland grid, thereby enhancing energy security. The submarine power-cable market is thus positioned to benefit from this strategic shift towards energy independence and sustainability.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the submarine power-cable market. The UK government has committed to substantial investments in renewable energy infrastructure, with a focus on enhancing grid connectivity. The Offshore Transmission Network Review aims to streamline the regulatory framework, potentially leading to a £10 billion investment in submarine power-cable projects by 2030. This financial backing is crucial for the submarine power-cable market, as it encourages innovation and the development of advanced technologies, ultimately facilitating the transition to a low-carbon energy system.

Expansion of Offshore Wind Projects

The expansion of offshore wind projects is a critical driver for the submarine power-cable market. The UK has established itself as a leader in offshore wind energy, with over 10 GW of installed capacity as of 2023. This growth trajectory is expected to continue, with projections indicating an increase to 30 GW by 2030. Such ambitious targets necessitate extensive submarine power-cable installations to connect these wind farms to the national grid. The submarine power-cable market is likely to see substantial investments and developments as stakeholders recognize the importance of reliable and efficient energy transmission systems.

Rising Interconnectivity with Europe

The rising interconnectivity with Europe is influencing the submarine power-cable market significantly. The UK is enhancing its electricity interconnections with neighboring countries, such as France and the Netherlands, to bolster energy security and facilitate cross-border electricity trading. Projects like the IFA2 interconnector, which connects the UK to France, exemplify this trend. The submarine power-cable market is likely to benefit from these developments, as increased interconnectivity requires the installation of additional submarine cables to support the growing demand for electricity exchange and to stabilize the grid.

Technological Advancements in Cable Design

Technological advancements in cable design are transforming the submarine power-cable market. Innovations such as high-voltage direct current (HVDC) technology enable more efficient long-distance electricity transmission, reducing energy losses. The adoption of advanced materials and manufacturing techniques is also enhancing the durability and performance of submarine cables. As the submarine power-cable market embraces these technological improvements, it is expected to witness increased demand for modern cable solutions that can support the growing offshore renewable energy sector and meet the challenges of harsh marine environments.