Expansion of E-commerce Platforms

The expansion of e-commerce platforms is reshaping the smart toys market in the UK. Online shopping has become increasingly popular, providing consumers with greater access to a diverse range of smart toys. This shift is evidenced by a reported 40% increase in online toy sales in 2025, as more parents opt for the convenience of purchasing toys online. E-commerce platforms also enable manufacturers to reach a broader audience, facilitating the introduction of innovative products to the market. As online shopping continues to grow, it is likely that the smart toys market will benefit from enhanced visibility and accessibility, further driving its expansion.

Rising Demand for Interactive Play

The smart toys market in the UK is experiencing a notable increase in demand for interactive play experiences. Parents are increasingly seeking toys that engage children in meaningful ways, promoting cognitive development and social skills. This trend is reflected in market data, which indicates that interactive toys accounted for approximately 35% of total toy sales in the UK in 2025. The appeal of smart toys lies in their ability to adapt to a child's learning pace, providing personalized experiences that traditional toys cannot offer. As a result, manufacturers are investing in advanced technologies to enhance interactivity, thereby driving growth in the smart toys market.

Technological Advancements in Toy Design

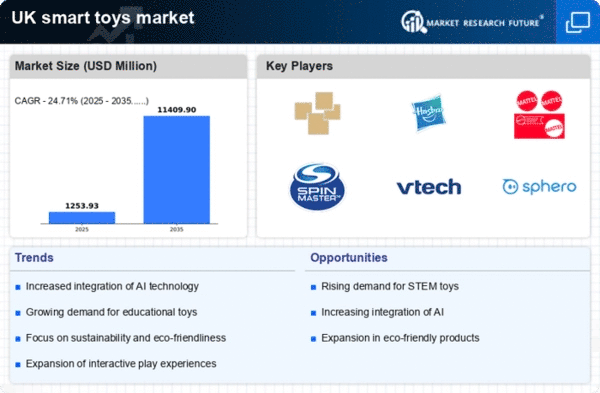

Technological advancements are significantly influencing the smart toys market in the UK. Innovations such as artificial intelligence, augmented reality, and machine learning are being integrated into toy designs, enhancing user experience and engagement. For instance, toys that can respond to voice commands or adapt to a child's preferences are becoming more prevalent. This trend is supported by market data indicating that the segment of smart toys utilizing advanced technology is projected to grow by 25% annually through 2027. As these technologies become more accessible, manufacturers are likely to continue developing cutting-edge products that appeal to tech-savvy consumers, thereby driving the smart toys market.

Growing Focus on Safety and Quality Standards

Safety and quality standards are becoming increasingly critical in the smart toys market. In the UK, regulatory bodies are enforcing stringent safety regulations to ensure that toys are safe for children. This focus on safety is influencing consumer purchasing decisions, with parents prioritizing products that meet high-quality standards. Market analysis indicates that toys meeting these safety certifications are likely to capture a larger market share, as approximately 70% of parents express concerns about toy safety. Consequently, manufacturers are investing in quality assurance processes and materials, which not only enhances product safety but also boosts consumer confidence in the smart toys market.

Increased Parental Awareness of Educational Benefits

There is a growing awareness among parents in the UK regarding the educational benefits of smart toys. These toys are designed to foster learning through play, which aligns with modern educational philosophies that emphasize experiential learning. Market Research Future suggests that around 60% of parents consider educational value as a key factor when purchasing toys. This shift in consumer behavior is propelling the smart toys market forward, as manufacturers are increasingly highlighting the developmental advantages of their products. The emphasis on STEM (Science, Technology, Engineering, and Mathematics) learning through smart toys is particularly resonating with parents, further solidifying the market's growth trajectory.