Consumer Awareness and Engagement

There is a growing awareness among consumers regarding energy consumption and sustainability in the UK. This shift in consumer behavior is driving demand for smart grid technologies that promote energy efficiency and enable greater control over energy usage. The smart grid-networking market is likely to expand as consumers seek solutions that provide insights into their energy consumption patterns and facilitate participation in demand response programs. Utilities are increasingly recognizing the importance of engaging consumers through smart technologies, which can lead to enhanced customer satisfaction and loyalty. This trend is expected to encourage further investment in smart grid solutions that cater to the evolving preferences of consumers.

Increased Focus on Energy Security

Energy security has become a critical concern for the UK, particularly in light of geopolitical tensions and the need for a resilient energy supply. The smart grid-networking market is poised to benefit from this heightened focus, as smart grid technologies enhance the reliability and security of energy systems. By enabling better monitoring and control of energy flows, smart grids can mitigate risks associated with supply disruptions. The UK government and energy providers are likely to invest in smart grid solutions that bolster energy security, thereby driving market growth. This focus on resilience is expected to lead to increased funding for smart grid projects, further stimulating the market.

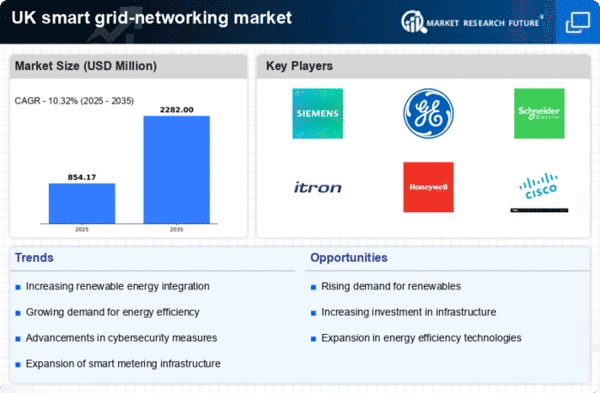

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources in the UK is a significant driver for the smart grid-networking market. As the country aims to achieve its target of generating 70% of its electricity from renewable sources by 2030, the need for an efficient and reliable grid becomes paramount. Smart grid technologies facilitate the integration of renewable energy sources, such as wind and solar, into the existing infrastructure. This integration is crucial for managing the variability of renewable energy generation. The smart grid-networking market is likely to see substantial growth as utilities and energy providers invest in technologies that enhance grid flexibility and reliability, ensuring a stable energy supply.

Government Initiatives and Policies

The UK government has been actively promoting the adoption of smart grid technologies through various initiatives and policies. These efforts aim to enhance energy efficiency and reduce carbon emissions, which are critical components of the UK's climate goals. The smart grid-networking market benefits from funding programs and regulatory frameworks that encourage innovation and investment in advanced energy systems. For instance, the government has allocated approximately £400 million to support smart grid projects, which is expected to stimulate growth in the market. This proactive stance not only fosters technological advancements but also creates a conducive environment for public-private partnerships, thereby driving the smart grid-networking market forward.

Technological Advancements in Energy Management

Technological innovations in energy management systems are transforming the smart grid-networking market. The advent of advanced metering infrastructure (AMI), demand response technologies, and real-time data analytics enables utilities to optimize energy distribution and consumption. These advancements not only improve operational efficiency but also enhance customer engagement by providing consumers with real-time insights into their energy usage. The market is projected to grow as more utilities adopt these technologies to meet the evolving demands of consumers and regulatory requirements. The integration of artificial intelligence and machine learning into energy management systems further enhances the capabilities of smart grids, making them more adaptive and responsive.