Consumer Engagement and Empowerment

Consumer engagement is increasingly shaping the smart grid-networking market. With the rise of smart meters and home energy management systems, consumers are becoming more proactive in managing their energy usage. This shift empowers consumers to make informed decisions about their energy consumption, leading to increased demand for smart grid solutions. The market is responding to this trend by developing user-friendly applications that provide insights into energy usage patterns. As consumer awareness grows, the smart grid-networking market is likely to expand, with projections indicating a potential increase in market penetration by 25% over the next few years.

Rising Demand for Energy Efficiency

The growing emphasis on energy efficiency is a significant driver for the smart grid-networking market. Consumers and businesses alike are increasingly seeking ways to reduce energy consumption and lower costs. Smart grid technologies enable real-time monitoring and management of energy usage, which can lead to substantial savings. According to recent estimates, energy efficiency measures can reduce energy consumption by up to 30% in some sectors. This demand for efficiency is pushing utilities to invest in smart grid solutions that provide better data analytics and control. Consequently, the smart grid-networking market is likely to see a surge in adoption as stakeholders recognize the financial and environmental benefits of energy-efficient practices.

Regulatory Support for Modernization

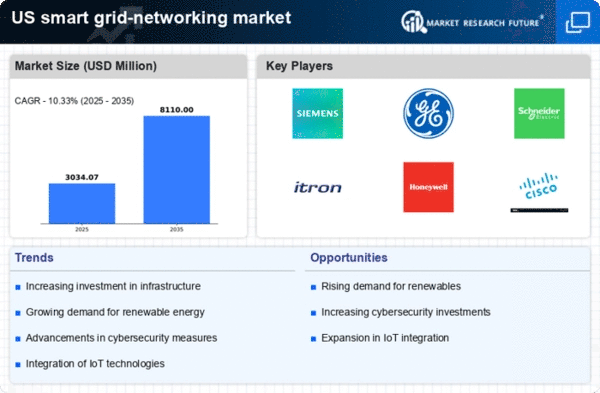

The smart grid-networking market benefits from robust regulatory frameworks that promote modernization of energy infrastructure. In the US, federal and state policies are increasingly encouraging utilities to adopt advanced technologies. The Energy Policy Act and various state-level initiatives provide financial incentives for utilities to invest in smart grid solutions. This regulatory support is crucial as it not only facilitates the deployment of smart grid technologies but also ensures compliance with environmental standards. As a result, the market is projected to grow at a CAGR of approximately 20% over the next five years, driven by these supportive policies. The smart grid-networking market is thus positioned to thrive as utilities align their operations with regulatory expectations.

Technological Advancements in Communication

Advancements in communication technologies are transforming the smart grid-networking market. Innovations such as 5G and IoT are enhancing the capabilities of smart grid systems, allowing for faster data transmission and improved connectivity. These technologies facilitate real-time monitoring and control of energy systems, which is essential for optimizing grid performance. The integration of advanced communication technologies is expected to drive the market's growth, with estimates suggesting a potential increase in market size by over $10 billion by 2030. As these technologies continue to evolve, the smart grid-networking market will likely experience enhanced operational efficiencies and improved service delivery.

Increased Focus on Resilience and Reliability

The need for enhanced resilience and reliability in energy systems is a critical driver for the smart grid-networking market. Natural disasters and aging infrastructure have highlighted vulnerabilities in traditional energy systems. As a response, utilities are investing in smart grid technologies that improve grid resilience through better monitoring and predictive maintenance. The smart grid-networking market is witnessing a shift towards solutions that can withstand disruptions and ensure continuous power supply. This focus on reliability is expected to contribute to a market growth rate of around 15% annually, as utilities prioritize investments in technologies that enhance system robustness.