Public Awareness and Education

Public awareness regarding the benefits of smart grid technologies is increasing in Japan, which is positively influencing the smart grid-networking market. Educational campaigns and community engagement initiatives are helping consumers understand the advantages of smart grids, such as improved energy management and environmental sustainability. As awareness grows, more individuals and businesses are likely to adopt smart grid solutions, contributing to market expansion. Surveys indicate that approximately 70% of consumers are now more informed about energy efficiency technologies, suggesting a shift in consumer behavior that could lead to increased market penetration for smart grid technologies.

Government Initiatives and Policies

The Japanese government actively promotes the adoption of smart grid technologies through various initiatives and policies. This includes substantial investments in infrastructure aimed at enhancing energy efficiency and sustainability. The government has set ambitious targets for reducing greenhouse gas emissions, which necessitates the integration of advanced technologies in the energy sector. As a result, the smart grid-networking market is expected to benefit from these supportive policies, with funding allocations reaching approximately $1 billion annually. Furthermore, regulatory frameworks are being established to facilitate the deployment of smart grid solutions, thereby creating a conducive environment for market growth.

Rising Demand for Energy Efficiency

There is a growing demand for energy efficiency among consumers and businesses in Japan, which is driving the smart grid-networking market. As energy costs continue to rise, stakeholders are increasingly seeking solutions that optimize energy consumption. Smart grid technologies enable better energy management through advanced metering and demand response systems, which can lead to reductions in energy bills by up to 20%. This heightened awareness and demand for energy-efficient solutions are likely to propel the market forward, as both residential and commercial sectors adopt smart grid technologies to enhance their energy management practices.

Increased Investment in Infrastructure

Japan is witnessing a surge in investments aimed at modernizing its energy infrastructure, which is a critical driver for the smart grid-networking market. The government and private sector are collaborating to upgrade aging electrical grids and incorporate smart technologies. Investments in this sector are projected to exceed $10 billion by 2027, focusing on enhancing grid reliability and integrating renewable energy sources. This influx of capital is expected to accelerate the deployment of smart grid solutions, thereby fostering innovation and improving overall energy efficiency. The modernization of infrastructure is essential for meeting future energy demands and ensuring a sustainable energy landscape.

Technological Advancements in Communication

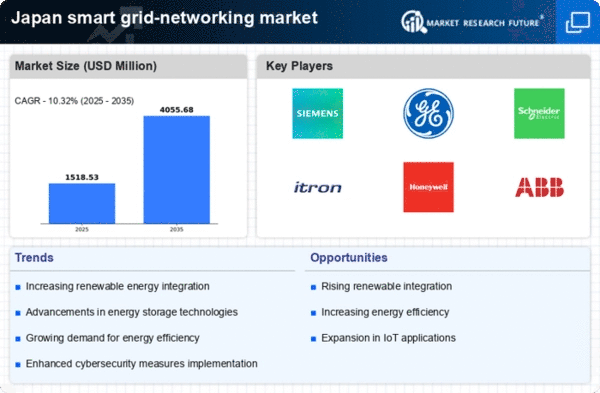

Rapid advancements in communication technologies are significantly impacting the smart grid-networking market in Japan. Innovations such as 5G and IoT are enhancing the capabilities of smart grids, enabling real-time data transmission and improved grid management. These technologies facilitate better monitoring and control of energy distribution, which is crucial for integrating renewable energy sources. The market is projected to grow at a CAGR of around 15% over the next five years, driven by these technological improvements. Enhanced communication systems not only optimize energy usage but also improve the reliability and resilience of the grid, making it a vital driver for the smart grid-networking market.