E-commerce Growth

The rise of e-commerce in the UK has a profound impact on the packaging printing market. As online shopping continues to expand, the demand for innovative and attractive packaging solutions increases. Retailers are seeking packaging that not only protects products but also enhances the unboxing experience for consumers. In 2025, the e-commerce sector is projected to account for approximately 30% of total retail sales in the UK, driving the need for efficient packaging solutions. This trend compels packaging manufacturers to adapt quickly, offering designs that cater to the unique requirements of online sales, such as lightweight materials and easy-to-open features. Consequently, the packaging printing market is likely to witness a surge in demand for custom printed packaging that aligns with brand identity and consumer expectations.

Regulatory Compliance

Regulatory compliance is a critical driver for the packaging printing market in the UK. The government has implemented stringent regulations regarding packaging materials, labeling, and waste management. These regulations aim to reduce environmental impact and promote recycling. For instance, the UK government has set ambitious targets to eliminate avoidable plastic waste by 2042, which influences packaging design and materials used. Companies in the packaging printing market must ensure that their products meet these regulations to avoid penalties and maintain market access. This compliance not only drives innovation in sustainable packaging solutions but also encourages businesses to invest in eco-friendly materials and processes. As a result, the packaging printing market is likely to experience growth as companies seek to align with regulatory standards while appealing to environmentally conscious consumers.

Technological Integration in Production

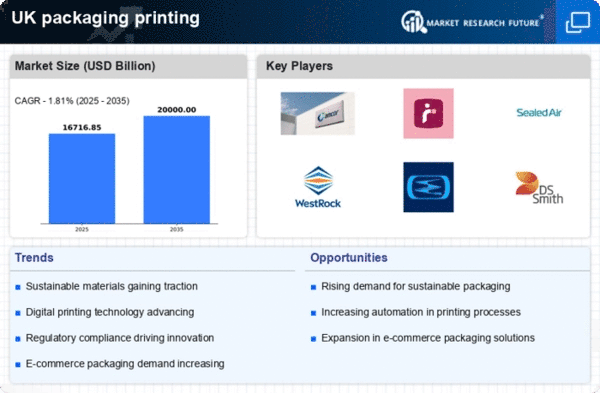

Technological integration in production processes is reshaping the packaging printing market. Advancements in printing technology, such as digital printing and automation, are enhancing efficiency and reducing production costs. In the UK, the adoption of digital printing technology is expected to grow by approximately 15% annually, as it allows for shorter production runs and greater customization. This technological shift enables packaging manufacturers to respond swiftly to market demands and consumer preferences. Moreover, automation in production lines streamlines operations, reducing lead times and minimizing waste. As a result, companies in the packaging printing market are likely to invest in these technologies to improve their competitive edge and meet the evolving needs of clients. The integration of technology not only enhances productivity but also fosters innovation in packaging design and functionality.

Rising Demand for Custom Packaging Solutions

The rising demand for custom packaging solutions is a notable driver in the packaging printing market. As brands strive to differentiate themselves in a crowded marketplace, unique and personalized packaging has become essential. In the UK, businesses are increasingly recognizing the value of custom packaging in enhancing brand identity and consumer engagement. Approximately 60% of UK consumers report that they are more likely to purchase a product if it features distinctive packaging. This trend encourages packaging manufacturers to offer tailored solutions that reflect the brand's ethos and resonate with target audiences. Consequently, the packaging printing market is likely to see a surge in demand for bespoke designs, innovative materials, and creative printing techniques. This focus on customization not only enhances consumer experience but also drives brand loyalty and repeat purchases.

Consumer Preferences for Eco-Friendly Packaging

Consumer preferences are shifting towards eco-friendly packaging solutions, significantly influencing the packaging printing market. In the UK, a growing number of consumers are prioritizing sustainability in their purchasing decisions. Research indicates that approximately 70% of UK consumers are willing to pay more for products with sustainable packaging. This trend compels brands to adopt environmentally friendly materials and printing techniques, thereby driving innovation within the packaging printing market. Companies are increasingly investing in biodegradable, recyclable, and compostable materials to meet consumer demand. This shift not only enhances brand loyalty but also positions companies favorably in a competitive market. As the trend towards sustainability continues, the packaging printing market is expected to evolve, with a focus on developing packaging solutions that align with consumer values and environmental responsibility.