E-commerce Growth

The rise of e-commerce is significantly impacting the Global Digital Printing Packaging Market Industry, as online retailers seek innovative packaging solutions to enhance customer experience. Digital printing allows for unique packaging designs that can be tailored for specific products, improving brand visibility and customer satisfaction. With the increasing volume of online orders, packaging must not only be visually appealing but also functional and protective. This trend is expected to drive demand for digital printing packaging solutions, as businesses aim to differentiate themselves in a crowded marketplace. The ongoing growth of e-commerce is likely to contribute to the market's expansion, further solidifying its relevance in the packaging industry.

Regulatory Compliance

Regulatory compliance is becoming a crucial driver in the Global Digital Printing Packaging Market Industry, as governments worldwide implement stricter packaging regulations. These regulations often focus on materials used, recyclability, and labeling requirements, compelling companies to adopt digital printing technologies that can easily adapt to changing standards. Digital printing offers the flexibility to modify designs and information quickly, ensuring compliance without significant production delays. As businesses strive to meet these regulatory demands, the adoption of digital printing solutions is expected to increase, thereby supporting market growth and enhancing the overall sustainability of packaging practices.

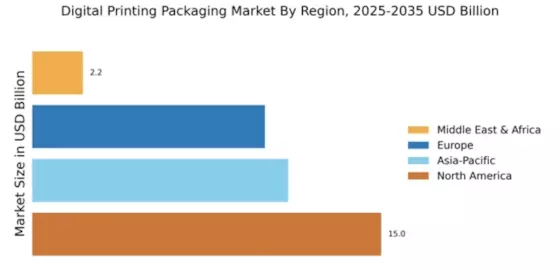

Market Growth Projections

The Global Digital Printing Packaging Market Industry is poised for substantial growth, with projections indicating a market value of 38.2 USD Billion in 2024 and an anticipated increase to 110.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 10.12% from 2025 to 2035. Factors contributing to this expansion include the rising demand for sustainable packaging solutions, advancements in printing technology, and the increasing prevalence of e-commerce. As businesses continue to innovate and adapt to consumer preferences, the digital printing packaging sector is likely to experience robust growth, reflecting broader trends in the packaging industry.

Sustainability Initiatives

The Global Digital Printing Packaging Market Industry is increasingly influenced by sustainability initiatives as consumers demand eco-friendly packaging solutions. Companies are adopting digital printing technologies that utilize less energy and produce less waste compared to traditional methods. For instance, digital printing allows for on-demand production, reducing excess inventory and minimizing environmental impact. This shift towards sustainable practices is not only beneficial for the environment but also aligns with consumer preferences, potentially driving market growth. As the market evolves, sustainability is expected to play a pivotal role in shaping packaging strategies, contributing to the projected market value of 38.2 USD Billion in 2024.

Technological Advancements

Technological advancements are reshaping the Global Digital Printing Packaging Market Industry, facilitating enhanced efficiency and quality in packaging production. Innovations in printing technology, such as improved ink formulations and faster printing speeds, are enabling manufacturers to produce high-quality packaging solutions at lower costs. Furthermore, the integration of automation and artificial intelligence in digital printing processes is streamlining operations, reducing lead times, and minimizing errors. These advancements are likely to attract more businesses to adopt digital printing, contributing to an anticipated compound annual growth rate of 10.12% from 2025 to 2035, as companies seek to enhance their competitive edge.

Customization and Personalization

Customization and personalization are emerging as key drivers in the Global Digital Printing Packaging Market Industry. Brands are increasingly leveraging digital printing technologies to create tailored packaging solutions that resonate with consumers. This trend is particularly evident in sectors such as food and beverage, where unique packaging designs can enhance brand identity and consumer engagement. The ability to produce small batches with distinct designs allows companies to respond swiftly to market trends and consumer preferences. As a result, the market is likely to experience significant growth, with projections indicating a value of 110.2 USD Billion by 2035, driven by the demand for personalized packaging.