Increased Awareness and Education

The heightened awareness surrounding Type 1 diabetes is driving growth in the Type 1 Diabetes Treatment Market. Educational campaigns aimed at both healthcare professionals and the general public are fostering a better understanding of the disease, its symptoms, and management strategies. This increased awareness is likely to lead to earlier diagnoses and more proactive treatment approaches. Furthermore, as patients become more informed about their condition, they may actively seek out advanced treatment options, thereby stimulating market demand. The emphasis on education is also encouraging healthcare providers to adopt best practices in diabetes management, which could further enhance the effectiveness of treatments available in the Type 1 Diabetes Treatment Market.

Rising Prevalence of Type 1 Diabetes

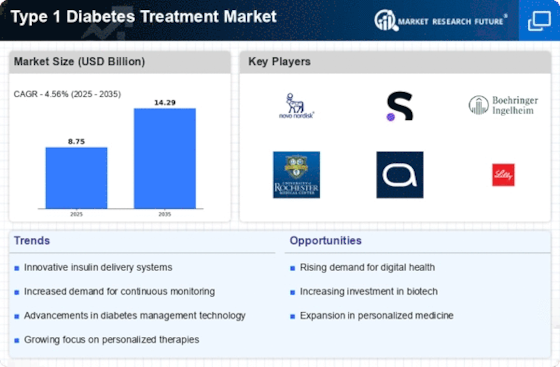

The increasing incidence of Type 1 diabetes is a primary driver for the Type 1 Diabetes Treatment Market. Recent estimates indicate that the prevalence of Type 1 diabetes is on the rise, with a notable increase in diagnoses among children and adolescents. This trend is likely to escalate demand for effective treatment options, as more individuals require management solutions. The growing awareness of Type 1 diabetes and its long-term complications further emphasizes the need for innovative therapies. As healthcare systems adapt to this rising prevalence, investments in research and development are expected to surge, potentially leading to breakthroughs in treatment methodologies. Consequently, the Type 1 Diabetes Treatment Market is poised for growth as stakeholders respond to the urgent need for comprehensive care solutions.

Growing Investment in Diabetes Research

The surge in investment for diabetes research is a crucial driver for the Type 1 Diabetes Treatment Market. Governments and private organizations are increasingly allocating funds to explore novel treatment options and improve existing therapies. This financial commitment is likely to accelerate the development of innovative solutions, including potential cures and advanced management tools. Recent reports indicate that funding for diabetes research has reached unprecedented levels, reflecting a collective recognition of the disease's impact on public health. As research initiatives expand, the Type 1 Diabetes Treatment Market may witness the introduction of groundbreaking therapies that could redefine treatment paradigms and enhance patient quality of life.

Advancements in Insulin Delivery Systems

Technological innovations in insulin delivery systems are significantly influencing the Type 1 Diabetes Treatment Market. The introduction of smart insulin pens, continuous glucose monitors, and insulin pumps has transformed diabetes management, offering patients more precise control over their blood glucose levels. These advancements not only enhance patient adherence but also improve overall health outcomes. Market data suggests that the insulin delivery segment is experiencing robust growth, driven by the increasing adoption of these technologies. As patients seek more convenient and effective ways to manage their condition, the demand for advanced delivery systems is expected to rise. This trend indicates a shift towards more integrated and user-friendly solutions within the Type 1 Diabetes Treatment Market.

Regulatory Support for Innovative Therapies

Regulatory bodies are increasingly supporting the development of innovative therapies for Type 1 diabetes, which serves as a significant driver for the Type 1 Diabetes Treatment Market. Streamlined approval processes and incentives for research and development are encouraging pharmaceutical companies to invest in new treatment modalities. This regulatory environment is conducive to the introduction of cutting-edge therapies, including biologics and gene therapies, which hold promise for improved patient outcomes. As these innovations gain traction, the Type 1 Diabetes Treatment Market is likely to expand, offering patients access to a broader range of effective treatment options. The proactive stance of regulatory agencies may also enhance collaboration between stakeholders, further propelling market growth.