Rising Awareness and Education

Increased awareness and education regarding type 1 diabetes are crucial drivers for the type 1-diabetes-treatment market. Educational programs targeting both healthcare professionals and patients have been implemented across Japan, leading to better understanding and management of the disease. Surveys indicate that over 70% of patients now feel more informed about their treatment options compared to five years ago. This heightened awareness is likely to result in greater demand for advanced treatment solutions, as patients seek to optimize their health outcomes. Furthermore, community support groups and online platforms are fostering a culture of shared knowledge, which may further enhance treatment adherence and patient engagement.

Government Initiatives and Support

Government policies and initiatives aimed at improving diabetes care significantly influence the type 1-diabetes-treatment market. In Japan, the Ministry of Health, Labour and Welfare has implemented various programs to enhance diabetes management and education. These initiatives include funding for research, subsidies for diabetes medications, and public awareness campaigns. The government’s commitment to reducing the burden of diabetes is evident in its allocation of approximately $500 million annually for diabetes-related healthcare services. Such support is likely to encourage pharmaceutical companies to invest in the development of new treatments, thereby expanding the market and improving patient access to necessary therapies.

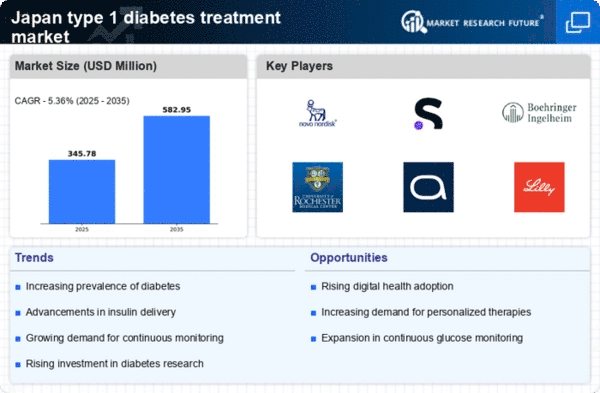

Increasing Prevalence of Type 1 Diabetes

The rising incidence of type 1 diabetes in Japan is a critical driver for the type 1-diabetes-treatment market. Recent statistics indicate that approximately 10,000 new cases are diagnosed annually, contributing to a growing patient population. This increase necessitates enhanced treatment options and management strategies, thereby expanding the market. The healthcare system is under pressure to provide effective therapies, which may lead to increased investments in research and development. Furthermore, the aging population in Japan, coupled with lifestyle changes, appears to exacerbate the prevalence of this condition. As a result, healthcare providers are likely to prioritize innovative treatment solutions, which could further stimulate market growth.

Emerging Biopharmaceuticals and Therapies

The emergence of biopharmaceuticals and novel therapies is transforming the type 1-diabetes-treatment market. Recent developments in insulin analogs and adjunct therapies, such as GLP-1 receptor agonists, are gaining traction in Japan. These innovative treatments offer improved efficacy and safety profiles, appealing to both patients and healthcare providers. The market for these biopharmaceuticals is expected to grow significantly, with projections indicating a potential increase of 20% in market share over the next few years. As research continues to unveil new therapeutic options, the competitive landscape is likely to evolve, prompting existing companies to enhance their product offerings and invest in clinical trials.

Technological Innovations in Diabetes Management

Technological advancements play a pivotal role in shaping the type 1-diabetes-treatment market. Innovations such as continuous glucose monitoring (CGM) systems and insulin pumps are becoming increasingly prevalent in Japan. These devices enhance patient adherence to treatment regimens and improve overall glycemic control. The market for CGM systems alone is projected to grow at a CAGR of 15% over the next five years. Additionally, the integration of mobile health applications with these technologies allows for real-time data sharing and personalized treatment adjustments. Such innovations not only empower patients but also facilitate better communication between healthcare providers and patients, potentially leading to improved health outcomes.