Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a notable driver for the type 2-diabetes-mellitus-treatment market. In 2020, national health spending reached approximately $4 trillion, with a significant portion allocated to chronic disease management, including diabetes. This trend suggests a growing recognition of the need for effective treatment solutions. As healthcare costs continue to rise, there is a push for innovative therapies that can reduce long-term complications associated with diabetes. The type 2-diabetes-mellitus-treatment market is likely to see increased investment in research and development, leading to the introduction of new treatment modalities. This financial commitment may enhance patient access to necessary therapies, further propelling market growth.

Growing Awareness and Education

Increased awareness and education regarding type 2 diabetes are driving the treatment market in the US. Public health campaigns and educational initiatives by organizations such as the American Diabetes Association have significantly improved understanding of diabetes management. As individuals become more informed about the risks associated with untreated diabetes, there is a corresponding rise in demand for effective treatment options. The type 2-diabetes-mellitus-treatment market is likely to benefit from this trend, as patients actively seek out therapies that can help manage their condition. Furthermore, healthcare providers are increasingly focusing on patient education as a means to enhance treatment adherence, which may further stimulate market growth.

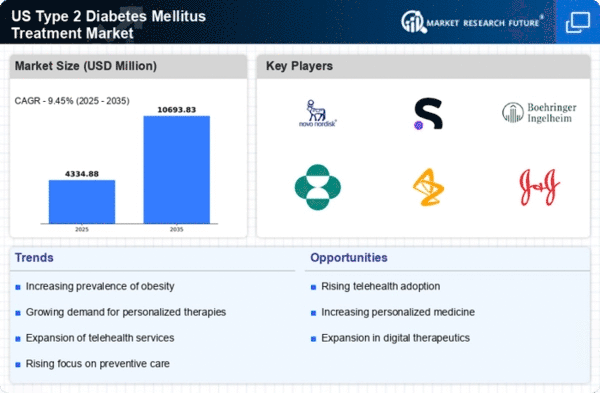

Increasing Prevalence of Obesity

The rising prevalence of obesity in the US is a critical driver for the type 2-diabetes-mellitus-treatment market. According to the Centers for Disease Control and Prevention (CDC), approximately 42.4% of adults in the US were classified as obese in 2017-2018. This alarming trend correlates with a higher incidence of type 2 diabetes, as excess body weight is a significant risk factor. The type 2-diabetes-mellitus-treatment market is likely to expand as healthcare providers seek effective interventions for this growing population. Furthermore, the economic burden associated with obesity-related health conditions is substantial, with estimated costs exceeding $147 billion annually. As awareness of obesity's impact on diabetes increases, demand for treatment options is expected to rise, driving market growth.

Advancements in Medical Technology

Technological advancements in medical devices and monitoring systems are transforming the type 2-diabetes-mellitus-treatment market. Innovations such as continuous glucose monitors (CGMs) and insulin delivery systems enhance patient management and adherence to treatment regimens. The integration of mobile health applications allows for real-time data tracking, which can lead to improved outcomes. The market for diabetes management devices is projected to reach $24 billion by 2026, indicating a robust growth trajectory. These advancements not only empower patients but also facilitate better communication between healthcare providers and patients, potentially leading to more personalized treatment plans. As technology continues to evolve, it is likely to play a pivotal role in shaping the future of the type 2-diabetes-mellitus-treatment market.

Regulatory Support for New Treatments

Regulatory support for the approval of new diabetes treatments is a crucial driver for the type 2-diabetes-mellitus-treatment market. The US Food and Drug Administration (FDA) has streamlined the approval process for innovative therapies, encouraging pharmaceutical companies to invest in research and development. This regulatory environment fosters the introduction of novel medications and treatment options, which can significantly impact patient outcomes. The type 2-diabetes-mellitus-treatment market is likely to benefit from this supportive framework, as it enables quicker access to effective therapies. As new treatments enter the market, competition may increase, potentially leading to more affordable options for patients and healthcare providers.