Market Trends

Key Emerging Trends in the Transition Metals Market

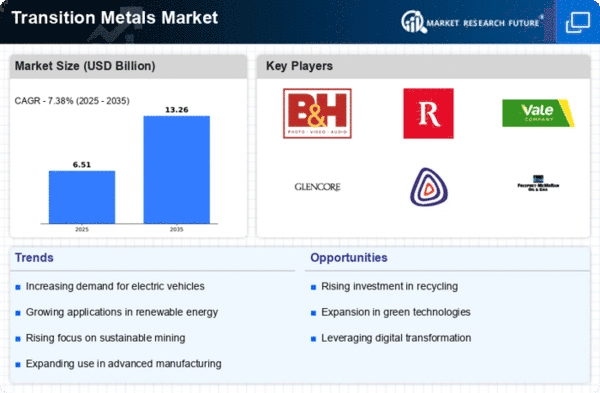

The dynamics of the transition metals market have experienced some significant changes recently as a result of technology developments taking place in different parts of the world, in addition to the global economic conditions, as well as various sustainability projects. Copper, one of the transition metals which demand has multiplied significantly is due to its vital role in electrification of vehicles. EV industry has grown so fast that the amount of copper used in electric motors, batteries and power connectors alone, has grown vigorously. As a result, with the fast intensifying global efforts to complete COP21 (the 21st session of the Conference of Parties), the ability of copper to win big thanks to its wide usage in EV batteries and electric charging infrastructure has evidently come to light. These indications will very probably last and the automotive sector will keep transforming towards the greener and efficient kinds of energy.

Bouncing off is the rise of need for REEs (rare earth elements), which is a group of metals that largely stands behind the electronics, clean energy and defense production. China always has been leading the rest of the world when it comes to REE mining; however it is essential to guarantee the integrity of the flowchain, which accordingly has caused a surge demand from other countries. Thus, as with regard to rare earth production and processing, the latest trend is to find and introduce a more sustainable and diverse way of obtaining the supply.

The green energy turn will also change how transition metals are considered as important building blocks of the new trend in the market. However, metals the likes of lithium, cobalt, and nickel used in EV-batteries and energy storage devices have the highest demand as they are in this line of work. For the practical task of renewable energy electricity storage, these metals become the core of the fast-developing solutions. With improving battery tech, call for the metals used is going to last strong.

Moreso, the geopolitical factors are particularly relevant in the determination of the course of raw materials processes within the transition metals. Trade conflicts and supply chain disruptions have surfaced how overprotection of a few key suppliers in the supply chain drives the business into a more vulnerable state. This hence led to an urgent need by farmers and governments to change some of the upstream strategies and find ways of doing the distributing at the local level, or diversification of the sources. There is a growing tendency to channel the stable status of the key metals across the transit metals market, which has changed the market dynamics of transition metals.

Additionally, environmental issues and laws are some of the new times challenge that market trends follow. The growing level of recognition of the environmental impact of the extraction and the transition minerals processes has forced a shift towards sustainable mining and processing techniques. The industry players health their efforts to technology investment, to create less harm to environment and lower carbon footprint, improve the responsibility and accountability in supply chain aspect. This is altering the competition and penching of consumer preferences thus creating more demand for the ethical sourcing of the rare transition metals.

Leave a Comment