Top Industry Leaders in the Transition Metals Market

From propelling electric vehicles to powering smartphones and building skyscrapers, transition metals are the invisible hands shaping our modern world. These versatile elements, including copper, nickel, zinc, and lithium, form the backbone of countless industries and their demand continues to soar. The global transition metals market is a dynamic arena where established mining giants and nimble exploration companies clash for dominance. Let's delve into the strategies powering success, the factors influencing market share, and the recent developments shaping this critical resource landscape.

From propelling electric vehicles to powering smartphones and building skyscrapers, transition metals are the invisible hands shaping our modern world. These versatile elements, including copper, nickel, zinc, and lithium, form the backbone of countless industries and their demand continues to soar. The global transition metals market is a dynamic arena where established mining giants and nimble exploration companies clash for dominance. Let's delve into the strategies powering success, the factors influencing market share, and the recent developments shaping this critical resource landscape.

Strategies Mining Market Share:

Diversification and Exploration: Leading players like BHP and Rio Tinto are expanding their portfolios beyond traditional resources, exploring new deposits of critical minerals like cobalt and lithium to cater to the surging demand for renewable energy technologies.

Sustainable Practices: Environmental concerns are reshaping the mining landscape. Companies like Glencore are adopting responsible mining practices, minimizing environmental impact and investing in renewable energy sources for operations, appealing to environmentally conscious investors and consumers.

Technological Innovation: From autonomous mining vehicles to advanced mineral processing technologies, innovation is transforming the industry. Companies like Vale are pioneering cutting-edge extraction techniques and automation solutions to improve efficiency, reduce costs, and maximize resource utilization.

Strategic Partnerships and Collaborations: Collaboration is key in navigating the complex world of mining. Companies like Anglo American are partnering with technology companies, research institutions, and even local communities to share expertise, accelerate innovation, and ensure responsible resource development.

Vertical Integration and Supply Chain Optimization: Gaining control over the entire value chain, from exploration to refining, is a growing trend. Companies like Freeport-McMoRan are investing in downstream processing facilities to secure market share and optimize supply chains, reducing reliance on external suppliers.

Factors Shaping the Landscape:

-

Electrification and Green Technologies: The rise of electric vehicles, renewable energy technologies, and energy storage systems is driving significant demand for lithium, cobalt, and nickel, boosting specific segments of the transition metals market. -

Geopolitical Landscape and Supply Chain Disruptions: Political instability and trade tensions can disrupt supply chains and influence prices. Companies with diverse mining operations and robust logistics networks are better equipped to weather these challenges. -

Technological Advancements and Substitution Threats: New technologies like battery recycling and alternative materials could potentially disrupt established markets. Companies investing in research and development, and diversifying their portfolios, can mitigate these risks. -

Environmental Regulations and Social Responsibility: Stringent environmental regulations and increasing public scrutiny on ethical sourcing are shaping the industry. Companies with strong environmental and social responsibility programs gain a competitive edge. -

Regional Market Dynamics: Demand for transition metals varies across regions. Asia-Pacific is currently the largest consumer, driven by its rapid economic growth and focus on renewable energy development. However, Africa and Latin America hold significant untapped potential.

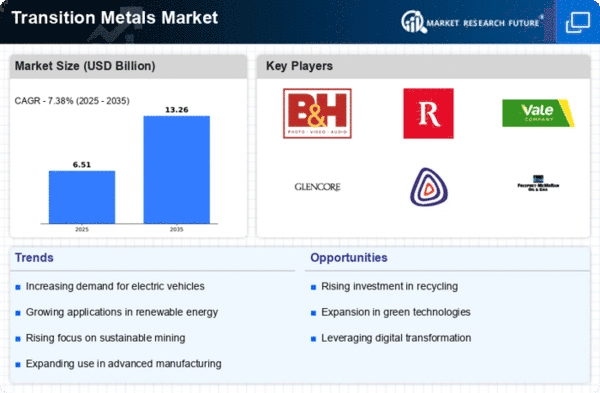

Key Players

- Reliance Steel & Aluminum Co (US)

- Transition Metals Corp (Canada)

- Fortescue Metals Group Limited(Australia)

- Samancor Chrome (South Africa)

- Vedanta Resources plc (Canada)

- Vale S.A. (Brazil)

- Teck Resources Limited (Canada)

- Rio Tinto Group (UK)

- Tshingshan Group (China)

- Norilsk Nickel (Russia)

- Metallurgical Products India Ltd (India)

- KGHM Polska Miedź S.A.(Poland)

- Rhenium Alloys (US)

Recent Developments:

-

September 2023: The European Union releases new regulations regarding the responsible sourcing of cobalt and other critical minerals, pushing mining companies to adopt ethical practices. -

October 2023: A consortium of leading mining companies and research institutions forms a collaborative research initiative to develop new technologies for sustainable and efficient extraction of transition metals. -

November 2023: Rio Tinto partners with a battery recycling startup to secure a reliable supply of recycled cobalt, reducing dependence on traditional mining and promoting sustainability. -

December 2023: Glencore unveils a new renewable energy-powered processing plant for zinc, showcasing its commitment to reducing its carbon footprint and minimizing environmental impact.