Market Analysis

In-depth Analysis of Transition Metals Market Industry Landscape

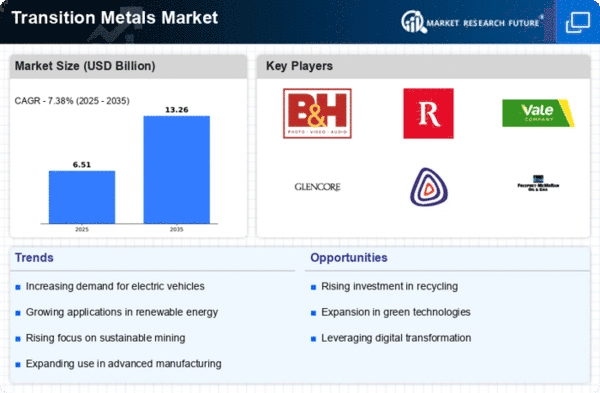

The market dynamics covering transition metals show the presence of some complexly inter-related factors that dominate the supply, demand and pricing. Transition metals, which are mainly situated in the centre of the periodic table, are the critical building blocks of a number of metal-related products, therefore, they must enjoy sustained demand.

Worldwide desire for the transition metals is at the base of these dynamics. These industries are primarily driven by industrial sectors as automotive industry, electronic appliances, and constructions. Formerly under developed countries increase in size, which offer a positive witness of the existence of a correlation between economic growth and transition metals consumption. This intensity of competition because of shocks in the demand often results in players implementing of new technological techniques to improve and optimization of their methods of exaction and processing.

Along with the demand side characteristics, supply-side dynamics which shape transition for the metals market play a crucial role too. As a result, the mining industry along with exploration activities, basically generate these metals so they are available and can be processed. Geological factors such as the location of mineral resources, geopolitical stability that influences cost of extraction, regulation on environment that affects supply chain contribute toward the ease of extraction and supply chain stability. To illustrate, connection problems hampering mining operations caused by geopolitical crises or unprecedented environmental disasters can lead to the declaration of a state of emergency and the corresponding price changes.

The metal market of transition is by origin is cyclical, with periods of excess over demand due to the oversupply followed by shortages brought by the phenomenon of shortage. Market players may encounter these fluctuations, so they are required to make sure they made informed decisions and did not lose on opportunities. Having a good production results in low rates then influence the country’s producer’s profit margins. But when outsanding supply meets itself with high demand, prices upsurge to attract mining companies and causes problems for industries in the downstream which depends greatly on these non-renewable metals.

The transition metals market often see corresponding technological developments and consumer behavior being the primary determinants of its fluctuations. With the evolution of industries, metals become more specific and certain metal stocks change the demand creating a necessity for capital to constantly change. For example, the matter of the focus on the expanding renewable energy sector has become the key to the supply of the metals (for example, lithium, cobalt, and rare earth elements) that are used in the production of the batteries for electric cars and environment-friendly technologies.

Trade dynamics also becomes rather complex alongside those of the commodity transition metals market. Countries with high endowments of minerals tend to become major importers of these commodities while at the same time very many of the commodity importing countries focus or invest heavily on strategic management of their supply chains. A variety of policies, tariff symbols and geopolitical relationships can change transition metals circulation worldwide, increasing prices and settling the raw material market.

Leave a Comment