By Region, the study segments the market into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Europe Tomato Processing Market accounts for the largest market share 27.64% in 2022 and is expected to exhibit a 2.57% CAGR due to the increasing demand for tomato products in HoReCa. The Europe Tomato Processing Market is experiencing significant growth and transformation, driven by evolving consumer preferences, technological advancements, and the increasing demand for processed tomato products.

As a key player in the global tomato processing industry, Europe has witnessed a surge in the production and consumption of various tomato-based products, including sauces, purees, pastes, and dried tomatoes. Further, Germany Tomato Processing Market held the largest market share, and the France Tomato Processing Market was the fastest-growing market in the Europe region.

Further, the major countries studied are: The U.S, Canada, Italy, Northern Africa, UK, Italy, Spain, China, Japan, India, Australia, New Zealand, South Korea, and Brazil.

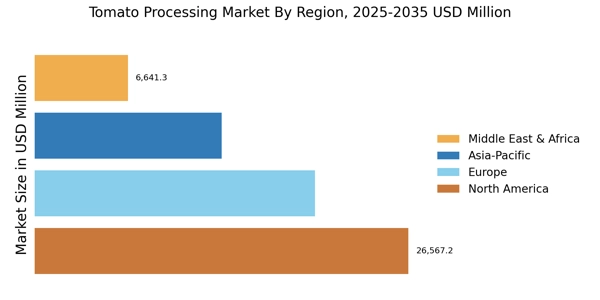

Figure 3: TOMATO PROCESSING MARKET SHARE BY REGION 2022 (%)

The North America tomato processing market stands as a dynamic and evolving sector, poised for continued growth and innovation. As of the latest assessments, the market has exhibited resilience and adaptability, navigating through various economic fluctuations and global challenges. The region's tomato processing industry has witnessed a paradigm shift in recent years, driven by consumer preferences, technological advancements, and sustainability considerations. In terms of market size and value, North America's tomato processing sector has demonstrated a consistent upward trajectory.

The increasing demand for processed tomato products, such as sauces, pastes, and diced tomatoes, has been a key driver propelling the market forward. Factors contributing to this surge include the rising trend of convenient and ready-to-cook meals, a growing awareness of health-conscious consumption, and the diverse application of tomato-based ingredients across the food industry. The North America Tomato Processing Market comprised of the US, Canada, & Mexico, among which the US emerged as frontrunner with a market share of 75.27% in 2023.

The Asia-Pacific Tomato Processing Market is expected to grow at a CAGR of 5.03% from 2023 to 2032. The Asia-Pacific Tomato Processing Market is poised for significant growth, driven by robust demand for processed tomato products across the region. With a burgeoning population and changing consumer preferences, the market is witnessing a paradigm shift towards convenience and ready-to-use food items, thereby fueling the demand for processed tomato products. The region's food industry is experiencing a surge in innovation, with companies focusing on advanced processing technologies to enhance the quality and shelf life of tomato-based products.

Key players are strategically investing in research and development to introduce new and diverse product offerings, capitalizing on the evolving taste preferences of consumers. Additionally, the increasing awareness regarding the health benefits of tomatoes is contributing to the market's expansion, as consumers seek healthier and natural alternatives in their diet. Moreover, China Tomato Processing Market held the largest market share, and the India Tomato Processing Market was the fastest-growing market in the Asia-Pacific region.

The South American tomato processing market is a dynamic and growing sector, driven by rising consumer demand for processed tomato products and advancements in processing technologies. The region boasts abundant agricultural resources, fertile soils, and favorable climatic conditions, making it a prime producer of quality tomatoes. The popularity of processed tomato products is fueled by their convenience, affordability, and versatility. Consumers appreciate the ability to incorporate tomato-based sauces, pastes, and juices into various cuisines and meal preparations.

The Middle East and Africa (MEA) region has witnessed a notable evolution in its tomato processing market, reflecting the changing dynamics of consumer preferences and dietary habits. As urbanization accelerates across the region, there has been a discernible rise in the demand for convenient and processed food items, propelling the growth of the tomato processing industry. Countries such as Egypt, Nigeria, South Africa, and Morocco have emerged as key players in this sector, with a focus on producing a diverse range of tomato-based products.