Market Growth Projections

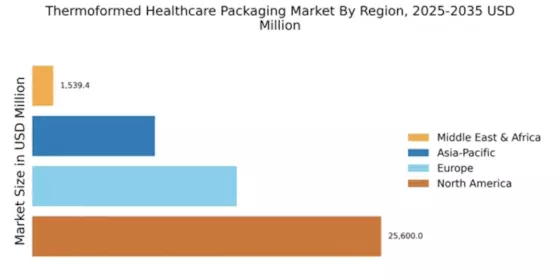

The Global Thermoformed Healthcare Packaging Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 51.1 USD Billion in 2024 and further expand to 115.7 USD Billion by 2035, the industry is poised for a robust trajectory. The anticipated CAGR of 7.7% from 2025 to 2035 reflects the increasing adoption of thermoformed packaging solutions across various healthcare applications. This growth is driven by factors such as technological advancements, rising healthcare expenditure, and a growing emphasis on sustainability, indicating a dynamic and evolving market landscape.

Growing Focus on Sustainability

Sustainability emerges as a pivotal driver within the Global Thermoformed Healthcare Packaging Market Industry. As environmental concerns gain prominence, healthcare manufacturers increasingly seek eco-friendly packaging solutions. Thermoformed packaging, often made from recyclable materials, aligns with these sustainability goals. Companies are exploring biodegradable options and reducing plastic waste, which resonates with consumers and regulatory bodies alike. This shift not only enhances brand reputation but also meets the growing demand for sustainable practices in healthcare. The industry's commitment to sustainability is likely to bolster its growth trajectory, as it adapts to changing consumer preferences and regulatory frameworks.

Increase in Healthcare Expenditure

The Global Thermoformed Healthcare Packaging Market Industry benefits from the rising healthcare expenditure observed globally. Governments and private sectors are investing significantly in healthcare infrastructure, leading to an increased demand for medical supplies and packaging solutions. This trend is particularly evident in emerging economies, where healthcare reforms are underway. As healthcare facilities expand and modernize, the need for reliable and efficient packaging solutions becomes critical. The industry's growth is further supported by the anticipated market value of 115.7 USD Billion by 2035, indicating a robust demand for thermoformed packaging in the healthcare sector.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are paramount in the Global Thermoformed Healthcare Packaging Market Industry. Stringent regulations governing medical packaging ensure that products meet safety and efficacy requirements. Thermoformed packaging solutions are designed to comply with these regulations, providing manufacturers with the assurance that their products are safe for use. This compliance not only protects patients but also enhances the credibility of healthcare providers. As regulatory bodies continue to enforce rigorous standards, the demand for compliant packaging solutions is likely to increase, driving growth within the industry.

Rising Demand for Advanced Medical Devices

The Global Thermoformed Healthcare Packaging Market Industry experiences a notable surge in demand for advanced medical devices. As healthcare providers increasingly adopt innovative technologies, the need for effective packaging solutions becomes paramount. Thermoformed packaging offers superior protection and customization, catering to the specific requirements of various medical devices. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 51.1 USD Billion in 2024. The ability of thermoformed packaging to enhance product visibility and ensure sterility aligns well with the evolving landscape of healthcare, thereby driving the industry's expansion.

Technological Advancements in Packaging Solutions

Technological advancements play a crucial role in shaping the Global Thermoformed Healthcare Packaging Market Industry. Innovations in materials and manufacturing processes enhance the functionality and efficiency of thermoformed packaging. For instance, the integration of smart packaging technologies, such as QR codes and temperature indicators, improves traceability and safety in healthcare applications. These advancements not only streamline operations but also enhance patient safety and compliance. As the industry embraces these technologies, it is poised for substantial growth, with a projected CAGR of 7.7% from 2025 to 2035, reflecting the increasing importance of advanced packaging solutions.