Global Trade Expansion

The expansion of global trade is a pivotal driver for the Global Testing Inspection and Certification for Agriculture and Food Market Industry. As countries engage in international trade, the need for standardized testing and certification becomes paramount to ensure compliance with various import and export regulations. For example, the United States and China have established stringent import requirements for agricultural products, necessitating thorough testing and certification. This trend is expected to contribute to the market's growth, with projections indicating a rise to 15.9 USD Billion by 2035, as businesses seek to navigate the complexities of global trade.

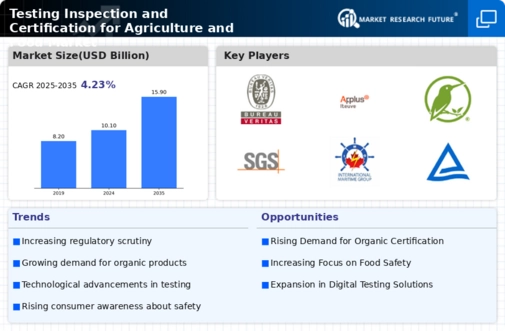

Market Growth Projections

The Global Testing Inspection and Certification for Agriculture and Food Market Industry is poised for robust growth, with projections indicating a market value of 10.1 USD Billion in 2024 and an anticipated increase to 15.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.22% from 2025 to 2035. Factors contributing to this expansion include rising food safety regulations, increased consumer awareness, and advancements in testing technologies. As the industry evolves, stakeholders must adapt to these changing dynamics to capitalize on emerging opportunities.

Rising Consumer Awareness

Consumer awareness regarding food safety and quality is significantly influencing the Global Testing Inspection and Certification for Agriculture and Food Market Industry. As consumers become more informed about the potential risks associated with foodborne illnesses, they increasingly demand transparency and assurance regarding the products they consume. This trend is prompting food manufacturers to seek certification from reputable testing agencies to build trust with their customers. The growing emphasis on organic and sustainably sourced products further amplifies this demand, as consumers are willing to pay a premium for certified goods, thereby enhancing the market's growth trajectory.

Increasing Food Safety Regulations

The Global Testing Inspection and Certification for Agriculture and Food Market Industry is experiencing a surge in demand due to the tightening of food safety regulations. Governments worldwide are implementing stricter guidelines to ensure food quality and safety, which necessitates comprehensive testing and certification processes. For instance, the European Union has introduced new regulations that require rigorous testing for pesticide residues in food products. This regulatory landscape is projected to drive the market's growth, as companies must invest in testing services to comply with these standards, thereby contributing to the market's valuation of 10.1 USD Billion in 2024.

Emerging Markets and Investment Opportunities

Emerging markets present substantial opportunities for the Global Testing Inspection and Certification for Agriculture and Food Market Industry. Countries in Asia, Africa, and Latin America are witnessing increased agricultural production and export activities, leading to a heightened demand for testing and certification services. As these regions develop their agricultural sectors, investments in testing infrastructure and certification bodies are becoming more prevalent. This trend not only supports local economies but also aligns with global standards, facilitating international trade. The market's growth in these regions is indicative of the broader trends shaping the industry.

Technological Advancements in Testing Methods

Technological advancements are revolutionizing the Global Testing Inspection and Certification for Agriculture and Food Market Industry. Innovations such as rapid testing methods, blockchain technology for traceability, and artificial intelligence for data analysis are enhancing the efficiency and accuracy of testing processes. These advancements enable quicker turnaround times for certification, which is crucial in a fast-paced market. As companies adopt these technologies, they are likely to see improved compliance with safety standards, thereby driving market growth. The anticipated compound annual growth rate of 4.22% from 2025 to 2035 reflects the potential impact of these technological innovations.