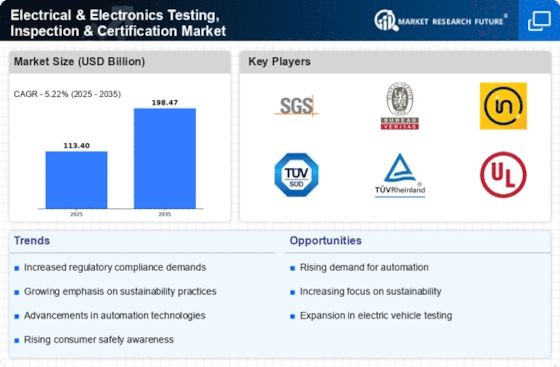

The key players in the market are investing heavily in research and development to broaden their product portfolios, driving the growth of the electrical and electronics testing, inspection, and certification market. Significant market developments can take a variety of shapes, such as contracts, mergers and acquisitions, increased investments, and partnerships with other companies. Significant industrial companies are also developing several programs to increase their global footprint. If the Electrical & Electronics Testing, Inspection & Certification Company is to grow and succeed in a difficult and competitive market, it must offer services at fair prices.

One of the key strategies companies use to please customers and grow the electrical and electronics testing, inspection, and certification market sector globally is local manufacturing to reduce operational costs. Electrical and electronics testing, inspection, and certification have recently brought considerable benefits to the Energy & Utilities industry. Major corporations in the Electrical & Electronics Testing, Inspection & Certification market, including SGS SA, Bureau Veritas SA, Dekra Certification Gmbh, Intertek Group PLC, and others, are trying to surge market demand by spending on research and development processes.

SGS is a global corporation with its headquarters in Geneva that offers services for inspection, verification, testing, and certification. Around the world, 2,650 offices and laboratories are run by 97,000 employees. SGS's core services include the inspection and verification of traded goods' weight, quantity, and quality; testing product performance and quality against a range of health, safety, and regulatory standards; and ensuring that goods, systems, or services adhere to the standards established by regulatory bodies, standardization organizations, or SGS's clients. SGS established a partnership with Microsoft in January 2022.

In order to provide cutting-edge solutions for the customers of the testing, inspection, and certification (TIC) industry, the collaboration will incorporate Microsoft's cross-industry knowledge, advanced data solutions, productivity platforms, worldwide network, and leading industry competence.

Technical services are offered independently by TUV Rheinland AG (TUV Rheinland). The business provides testing and assessment, training and qualification, inspection and supervision, consultancy and project management, certification, and auditing services. Its services offering includes testing, monitoring, development, promotion, and certification of goods, machinery, instruction, procedures, and management systems. The company provides services to a number of industries, including automotive, chemical, construction and real estate, consumer goods and retail, education, energy and utilities, finance and insurance, food, import-export, industrial manufacturing, infrastructure, leisure, and tourism. It works in a number of nations in Europe, Asia, Africa, and the Americas.

Germany's Cologne serves as the company's main office. Inspection Verification Bureau Ltd. (IVB) was successfully bought by TÜV Rheinland in November 2022. The global power, oil, gas, and renewable energy industries can make use of IVB's independent, specialized inspection and verification services. The acquisition strengthens TÜV Rheinland's position as an industry-leading full-service provider of supplementary services.