Stringent Regulatory Frameworks

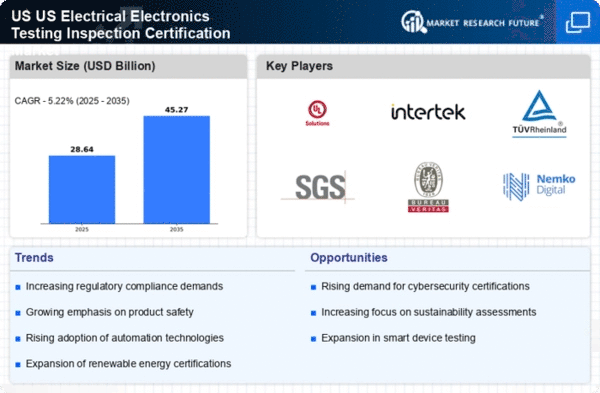

The US Electrical Electronics Testing Inspection Certification Market is significantly influenced by stringent regulatory frameworks established by government agencies such as the Federal Communications Commission (FCC) and the Underwriters Laboratories (UL). These regulations mandate compliance with safety, electromagnetic compatibility, and environmental standards. As of January 2026, the enforcement of these regulations has intensified, compelling manufacturers to prioritize testing and certification to avoid penalties and ensure market access. The increasing complexity of regulations necessitates specialized knowledge and expertise, thereby driving demand for testing and certification services. This trend underscores the critical role of regulatory compliance in maintaining product integrity and consumer safety.

Rising Awareness of Product Safety

The US Electrical Electronics Testing Inspection Certification Market is experiencing a notable increase in consumer awareness regarding product safety and quality. As consumers become more informed about the potential risks associated with electronic products, they are demanding higher safety standards from manufacturers. This trend is reflected in the growing preference for certified products, which are perceived as safer and more reliable. In 2025, surveys indicated that over 70% of consumers considered product certification as a critical factor in their purchasing decisions. Consequently, manufacturers are compelled to invest in testing and certification processes to meet consumer expectations and enhance brand reputation. This rising awareness is likely to drive sustained growth in the testing and certification market.

Growth of Renewable Energy Technologies

The US Electrical Electronics Testing Inspection Certification Market is witnessing a surge in the adoption of renewable energy technologies, such as solar and wind power systems. This growth is largely attributed to the US government's commitment to reducing carbon emissions and promoting sustainable energy solutions. In 2025, the renewable energy sector accounted for approximately 20% of the total energy consumption in the US, reflecting a significant shift towards cleaner energy sources. As these technologies proliferate, the need for rigorous testing and certification becomes paramount to ensure safety, efficiency, and compliance with industry standards. Testing organizations are thus positioned to support the renewable energy sector by providing essential certification services that validate the performance and safety of these technologies.

Increased Demand for Consumer Electronics

The US Electrical Electronics Testing Inspection Certification Market is experiencing heightened demand for consumer electronics, driven by technological advancements and changing consumer preferences. As the market for smart devices, wearables, and home automation systems expands, manufacturers are compelled to ensure compliance with safety and performance standards. In 2025, the consumer electronics sector in the US was valued at approximately 400 billion USD, indicating a robust growth trajectory. This surge necessitates rigorous testing and certification processes to mitigate risks associated with electronic products. Consequently, testing and certification organizations are positioned to play a pivotal role in validating product safety and efficacy, thereby fostering consumer trust and market acceptance.

Technological Advancements in Testing Methods

The US Electrical Electronics Testing Inspection Certification Market is being transformed by technological advancements in testing methods, including automation and artificial intelligence. These innovations enhance the efficiency and accuracy of testing processes, enabling faster turnaround times for certification. As of January 2026, many testing laboratories are integrating advanced technologies to streamline operations and improve data analysis capabilities. This shift not only reduces costs but also enhances the reliability of test results, which is crucial for manufacturers seeking to meet stringent regulatory requirements. The adoption of these advanced testing methods is likely to drive growth in the certification market, as companies increasingly seek to leverage technology to maintain competitive advantages.