Regulatory Push for Enhanced Connectivity

Regulatory initiatives aimed at enhancing connectivity are driving the Tantalum Capacitors for 5G Base Stations Market. Governments and regulatory bodies are increasingly recognizing the importance of robust telecommunications infrastructure for economic growth and social development. As a result, there is a concerted effort to promote the deployment of 5G networks, which necessitates the use of high-quality components like tantalum capacitors. These capacitors play a critical role in ensuring the reliability and efficiency of base stations, which are essential for meeting regulatory standards. The push for improved connectivity is expected to create a favorable environment for the growth of the tantalum capacitor market, as stakeholders seek to comply with new regulations and standards.

Increasing Deployment of 5G Infrastructure

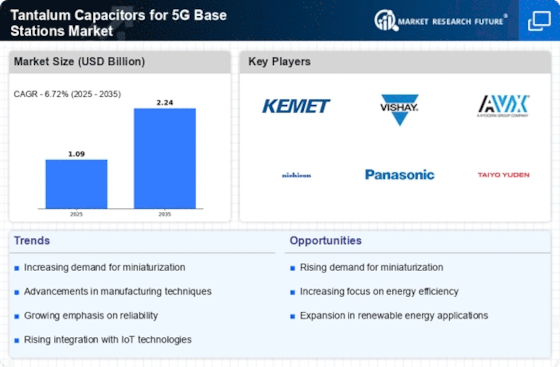

The rapid expansion of 5G infrastructure is a primary driver for the Tantalum Capacitors for 5G Base Stations Market. As telecommunications companies invest heavily in building new base stations, the demand for reliable and efficient components, such as tantalum capacitors, is surging. These capacitors are essential for managing power supply and signal integrity in high-frequency applications. According to industry estimates, the number of 5G base stations is projected to reach over 1 million by 2025, creating a substantial market for tantalum capacitors. This growth is fueled by the increasing need for faster data transmission and improved connectivity, which tantalum capacitors can effectively support due to their high capacitance and stability.

Technological Advancements in Capacitor Design

Innovations in capacitor design are significantly influencing the Tantalum Capacitors for 5G Base Stations Market. Advances in materials science and manufacturing techniques have led to the development of tantalum capacitors that offer enhanced performance characteristics, such as higher capacitance values and improved thermal stability. These advancements enable manufacturers to produce smaller and more efficient capacitors, which are crucial for the compact designs of modern 5G base stations. The market is witnessing a shift towards capacitors that can operate at higher frequencies and voltages, aligning with the demands of next-generation telecommunications. As a result, the adoption of advanced tantalum capacitors is expected to rise, further propelling market growth.

Growing Demand for High-Performance Electronics

The increasing demand for high-performance electronic devices is a significant driver for the Tantalum Capacitors for 5G Base Stations Market. As consumer electronics evolve, there is a pressing need for components that can support advanced functionalities and high-speed operations. Tantalum capacitors are favored in this context due to their superior performance in high-frequency applications, making them ideal for 5G base stations. The market for consumer electronics is projected to grow at a compound annual growth rate of over 6% through 2025, which will likely boost the demand for tantalum capacitors. This trend underscores the importance of these components in meeting the performance expectations of modern electronic devices.

Shift Towards Sustainable Manufacturing Practices

The shift towards sustainable manufacturing practices is emerging as a key driver for the Tantalum Capacitors for 5G Base Stations Market. As environmental concerns gain prominence, manufacturers are increasingly focusing on eco-friendly production methods and materials. Tantalum capacitors, known for their durability and long lifespan, align well with sustainability goals, as they reduce the need for frequent replacements. This trend is further supported by consumer preferences for environmentally responsible products. The market is likely to see a rise in demand for tantalum capacitors that are produced using sustainable practices, which could enhance their appeal in the 5G base station sector. This alignment with sustainability initiatives may also provide a competitive edge for manufacturers in the evolving market landscape.