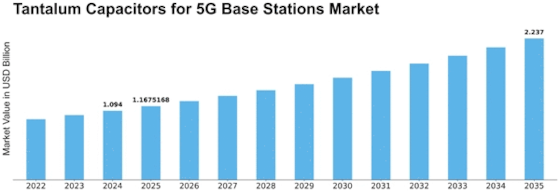

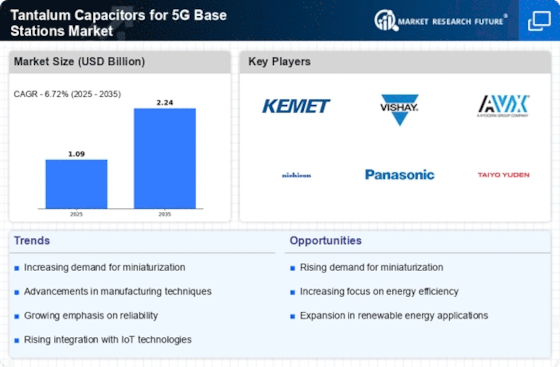

Tantalum Capacitors For 5g Base Stations Size

Tantalum Capacitors for 5G Base Stations Market Growth Projections and Opportunities

The market for tantalum capacitors in the context of 5G base stations is influenced by various factors that play a crucial role in shaping its dynamics. One key determinant is the increasing demand for 5G technology itself. As telecommunications continue to advance, the deployment of 5G networks becomes more widespread. Tantalum capacitors, known for their high capacitance and compact size, are integral components in the construction of 5G base stations. The rising adoption of 5G technology globally is thus a significant market driver for tantalum capacitors.

Another factor contributing to the market's growth is the evolving landscape of electronic devices. With the proliferation of smartphones, tablets, and IoT devices, there is a surge in the need for efficient and reliable electronic components. Tantalum capacitors, being essential in ensuring stable power supply and signal integrity, are in high demand to meet the performance requirements of these devices. As 5G technology becomes more intertwined with the Internet of Things (IoT), the market for tantalum capacitors is expected to witness sustained growth.

Supply chain dynamics and raw material availability also play a pivotal role in shaping the market for tantalum capacitors. Tantalum, the primary raw material used in manufacturing these capacitors, is sourced from a limited number of mines globally. Any disruptions in the tantalum supply chain, whether due to geopolitical issues or mining challenges, can have a direct impact on the production and pricing of tantalum capacitors. Manufacturers in the market need to closely monitor these factors to ensure a stable supply chain and mitigate potential risks.

The regulatory environment is another critical market factor influencing the production and usage of tantalum capacitors. Compliance with environmental regulations and ethical sourcing practices for raw materials, including tantalum, is increasingly important. Manufacturers are under pressure to adhere to responsible business practices, and adherence to these standards can impact the market reputation and competitiveness of companies in the tantalum capacitor sector.

Technological advancements and innovations in capacitor design also contribute to the market dynamics. As engineers and researchers develop new ways to enhance the performance and efficiency of electronic components, tantalum capacitor manufacturers need to stay at the forefront of these innovations. This involves investing in research and development to produce capacitors with higher capacitance, improved reliability, and smaller form factors – all crucial attributes in the context of 5G base station applications.

Market competition is fierce, with several players vying for market share. Established manufacturers and new entrants alike need to focus on product differentiation, cost competitiveness, and strategic partnerships to gain an edge in the tantalum capacitor market for 5G base stations. Additionally, the market is sensitive to economic conditions, as fluctuations in global economic health can impact infrastructure spending, including investments in 5G networks.

Leave a Comment