Growing Focus on Energy Efficiency

The increasing emphasis on energy efficiency in telecommunications is a notable driver for the tantalum capacitors-for-5g-base-stations market. As energy costs rise and environmental concerns become more pressing, telecommunications companies are seeking ways to reduce energy consumption in their operations. Tantalum capacitors are recognized for their low equivalent series resistance (ESR), which contributes to improved energy efficiency in power management systems. This characteristic makes them particularly valuable in 5G base stations, where energy efficiency is paramount. The market is likely to experience growth as companies prioritize energy-efficient solutions, positioning tantalum capacitors as a key component in the quest for sustainable telecommunications.

Increased Investment in Telecommunications

Investment in telecommunications infrastructure is a crucial driver for the tantalum capacitors-for-5g-base-stations market. With the ongoing rollout of 5G networks across the United States, telecommunications companies are allocating substantial budgets to enhance their capabilities. In 2025, it is estimated that the telecommunications sector will invest over $100 billion in 5G infrastructure, which will likely create a robust demand for high-quality components, including tantalum capacitors. These capacitors are essential for ensuring the stability and efficiency of power management systems in base stations. As a result, the tantalum capacitors-for-5g-base-stations market is poised to benefit from this influx of investment, as manufacturers respond to the heightened demand for advanced components.

Technological Advancements in 5G Infrastructure

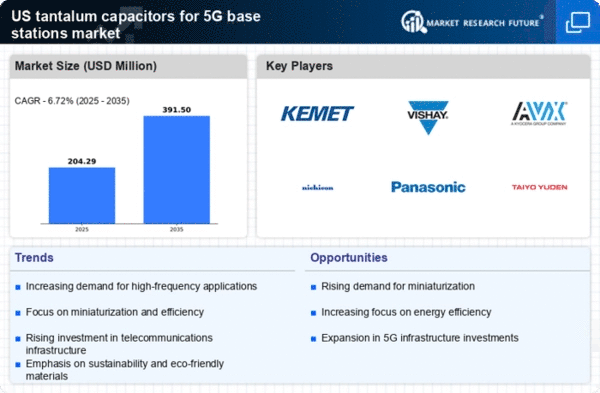

The rapid evolution of 5G technology is a primary driver for the tantalum capacitors-for-5g-base-stations market. As telecommunications companies invest heavily in upgrading their infrastructure, the demand for high-performance components, such as tantalum capacitors, is expected to surge. The market is projected to grow at a CAGR of approximately 15% from 2025 to 2030, reflecting the increasing need for reliable and efficient components in 5G base stations. These capacitors are essential for managing power supply and signal integrity, which are critical for the performance of 5G networks. Consequently, the tantalum capacitors-for-5g-base-stations market is likely to benefit from this technological shift, as manufacturers strive to meet the evolving requirements of next-generation communication systems.

Rising Adoption of Internet of Things (IoT) Devices

The proliferation of IoT devices is significantly influencing the tantalum capacitors-for-5g-base-stations market. As more devices become interconnected, the demand for robust and efficient communication networks intensifies. Tantalum capacitors are favored for their reliability and performance in high-frequency applications, making them ideal for 5G base stations that support IoT connectivity. The market for IoT is expected to reach $1 trillion by 2026, which will likely drive the need for enhanced 5G infrastructure. This trend suggests that the tantalum capacitors-for-5g-base-stations market will experience increased demand as manufacturers seek to provide the necessary components to support the growing IoT ecosystem.

Shift Towards Miniaturization of Electronic Components

The trend towards miniaturization in electronic components is significantly impacting the tantalum capacitors-for-5g-base-stations market. As devices become smaller and more compact, the need for high-capacity, space-efficient components increases. Tantalum capacitors are known for their small size and high capacitance, making them ideal for modern 5G base stations that require efficient use of space without compromising performance. This shift is likely to drive innovation in capacitor design and manufacturing, further enhancing the appeal of tantalum capacitors in the market. The tantalum capacitors-for-5g-base-stations market may see a rise in demand as manufacturers adapt to these miniaturization trends, ensuring that they meet the needs of contemporary electronic designs.