Market Trends

Key Emerging Trends in the Synthetic Lubricant Market

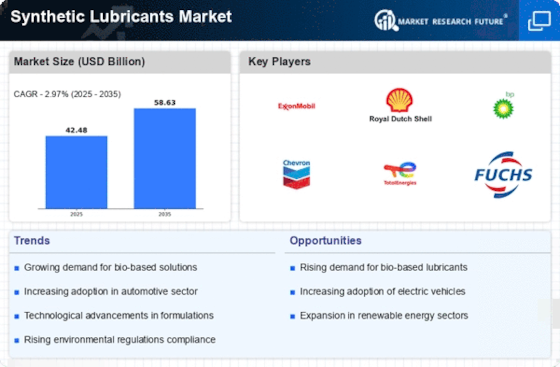

The synthetic lubricant market has been marked by significant trends, reflecting the growing demand for high-performance lubricants across various industries. Synthetic lubricants, formulated with artificially engineered base oils and additives, offer enhanced stability, durability, and efficiency compared to conventional mineral-based lubricants. Several key factors are shaping the market trends in the synthetic lubricant sector.

One notable trend in the synthetic lubricant market is the increasing adoption in the automotive industry. As vehicle manufacturers strive to meet stringent emissions standards and improve fuel efficiency, the demand for high-performance lubricants has risen. Synthetic lubricants, with their ability to withstand extreme temperatures and provide superior protection against wear and tear, have become the preferred choice for modern engines. This trend is expected to continue as the automotive industry undergoes further advancements, including the rise of electric vehicles and the development of more sophisticated engines.

Environmental sustainability is emerging as a crucial driver of market trends in the synthetic lubricant sector. With a growing focus on reducing the environmental impact of industrial processes, there is a shift towards synthetic lubricants that offer improved energy efficiency and longer service life. Manufacturers are developing eco-friendly formulations with biodegradable components and lower toxicity levels, aligning with global efforts to promote sustainable practices. This trend is particularly relevant in industries where lubricant leakage or disposal poses environmental risks.

Technological advancements play a pivotal role in shaping the synthetic lubricant market. Continuous research and development efforts are leading to the introduction of synthetic lubricants with superior performance characteristics. Innovations in base oil technology, additive chemistry, and formulation processes contribute to enhanced thermal stability, oxidation resistance, and anti-wear properties. The development of synthetic lubricants tailored to specific applications, such as industrial machinery or aviation, reflects the industry's commitment to providing optimized solutions for diverse end-users.

The industrial sector, encompassing manufacturing, energy, and machinery applications, is another key influencer of market trends in the synthetic lubricant sector. As industries evolve towards automation, precision machinery, and high-speed operations, the demand for synthetic lubricants capable of meeting stringent performance requirements is increasing. Synthetic lubricants offer advantages such as reduced friction, extended equipment life, and improved energy efficiency, making them integral to the smooth operation of industrial processes. This trend is expected to persist as industrial applications become more demanding and sophisticated.

Global economic factors and regional dynamics also impact market trends in the synthetic lubricant industry. Economic growth, industrial expansion, and infrastructure development contribute to the demand for synthetic lubricants across various regions. The Asia-Pacific region, with its rapid industrialization and manufacturing activities, has witnessed substantial growth in synthetic lubricant consumption. Moreover, regional regulations, such as emissions standards and environmental policies, influence the adoption of synthetic lubricants in different parts of the world.

When working with high temperatures, synthetic lubricants are used as an alternative for petroleum-refined oils. Growing environment regulations among the automotive sector regarding the reduction of carbon emissions are creating various opportunities for the manufacturers of synthetic lubricants to bolster market growth. By increasing investment in research and development, it is expected that to introduce environmental-friendly, efficient, and effective synthetic lubricants at lower prices which is the opportunity to escalate the market growth.

Leave a Comment