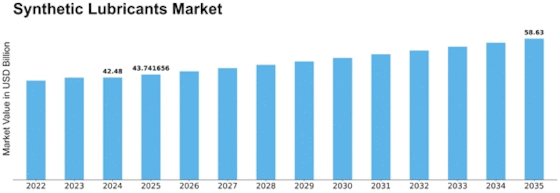

Synthetic Lubricant Size

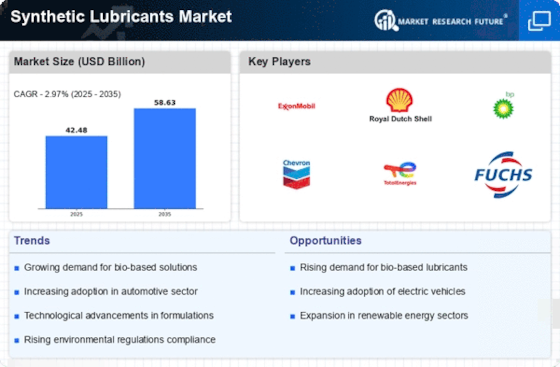

Synthetic Lubricant Market Growth Projections and Opportunities

The Synthetic Lubricant market is significantly influenced by a range of factors that collectively shape its dynamics. One of the primary determinants is the increasing demand for high-performance lubricants across diverse industries, including automotive, industrial machinery, and aviation. Synthetic lubricants, known for their superior thermal stability, oxidation resistance, and extended service life, cater to applications where extreme operating conditions and elevated temperatures are commonplace. The continuous growth of these end-use industries, driven by factors such as technological advancements, expanding transportation networks, and industrialization, directly impacts the demand for synthetic lubricants.

Synthetic Lubricants Market Size was valued at USD 7.9 billion in 2021. The synthetic lubricants market industry is projected to grow from USD 8.39 Billion in 2022 to USD 12.40 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.80%

Raw material dynamics play a pivotal role in the synthetic lubricant market, as the production of synthetic base oils involves the use of various chemicals and hydrocarbons. Fluctuations in the prices and availability of these raw materials, such as polyalphaolefins (PAO) and esters, can influence the overall production costs of synthetic lubricants. Factors like changes in crude oil prices, geopolitical events affecting the supply chain, and advancements in base oil technologies contribute to price volatility in the synthetic lubricant market. Companies in the sector must actively manage their supply chains to ensure a stable and cost-effective source of raw materials.

Regulatory standards and environmental considerations significantly shape the synthetic lubricant market. The push for reduced emissions and increased fuel efficiency in automotive and industrial applications has led to a growing preference for synthetic lubricants. Additionally, environmental regulations governing the use and disposal of lubricants emphasize the need for eco-friendly and biodegradable lubricant options. Companies that align their products with these regulatory and environmental considerations position themselves favorably in a market where sustainability is becoming a key decision-making factor.

Technological advancements contribute significantly to the evolution of the synthetic lubricant market. Ongoing innovations in lubricant formulations, additive technologies, and manufacturing processes aim to enhance the performance characteristics of synthetic lubricants. Companies that invest in research and development to introduce high-performance and application-specific synthetic lubricants gain a competitive edge in a market where technological innovation is crucial for meeting industry demands and gaining market share.

Global economic conditions and industry trends play a crucial role in shaping the synthetic lubricant market. Economic factors such as GDP growth, industrial production, and automotive sales influence the overall demand for lubricants, including synthetic variants. Changes in consumer preferences, advancements in vehicle technologies, and the expanding scope of industrial applications contribute to the market dynamics, making it essential for synthetic lubricant manufacturers to stay attuned to broader economic trends and industry developments.

Market competition is a constant consideration in the synthetic lubricant sector. The presence of multiple players, each offering a variety of synthetic lubricants for different applications, intensifies competition. Companies differentiate themselves through factors such as product quality, innovation, pricing strategies, and customer service. Mergers, acquisitions, and strategic partnerships are common strategies employed by companies to strengthen their market position, expand their product portfolios, and enhance their global reach.

Consumer preferences and industry trends also contribute to the synthetic lubricant market's evolution. Changing preferences for high-performance lubricants, increased adoption of synthetic oils in modern engines, and advancements in tribology and lubrication science influence the demand for specific types of synthetic lubricants. Companies that anticipate and adapt to these trends are better positioned to meet market demands effectively and capitalize on emerging opportunities.

Leave a Comment