Market Analysis

In-depth Analysis of Synthetic Lubricant Market Industry Landscape

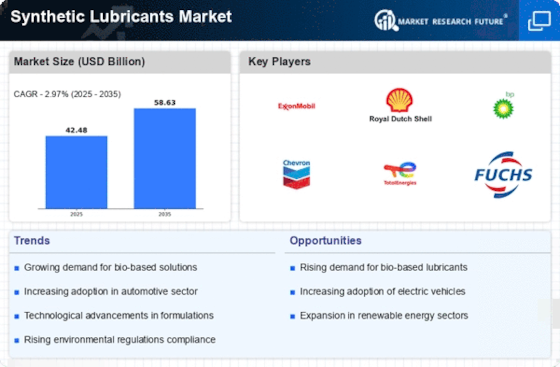

The market dynamics of the synthetic lubricant industry are influenced by a combination of factors that collectively shape its supply, demand, and pricing trends. Synthetic lubricants, engineered from chemically modified compounds, have gained prominence in various industries due to their superior performance characteristics, including enhanced thermal stability, oxidative resistance, and extended service life. One of the primary drivers of the synthetic lubricant market is the increasing demand for high-performance lubricants in automotive, industrial, and aerospace applications. The automotive sector, in particular, has witnessed a growing preference for synthetic lubricants as they contribute to improved fuel efficiency, reduced wear and tear, and extended engine life.

The growing demand for the automotive sector is driving the growth of the market. Owing to their superior characteristics, synthetic lubricants are used in various applications like process oil, engine oil, hydraulic oil, marine lubricants, metalworking fluids, and others which is boosting the demand for synthetic lubricants. The increasing automobile, construction, and power & energy industries for developing domestic and the commercial market

Geographical considerations play a pivotal role in shaping the market dynamics of synthetic lubricants, with major regions such as North America, Europe, and Asia-Pacific being key contributors. The Asia-Pacific region, driven by rapid industrialization and the automotive boom, stands out as a significant market for synthetic lubricants. Additionally, North America and Europe witness steady demand, propelled by stringent environmental regulations, technological advancements, and a focus on energy efficiency.

Technological advancements and innovations are key drivers influencing the market dynamics of the synthetic lubricant industry. Ongoing research and development efforts focus on enhancing the formulation of synthetic lubricants, introducing additives for specific applications, and addressing environmental concerns. Innovations such as bio-based synthetic lubricants, derived from renewable sources, are gaining traction as the industry aligns with sustainability goals and seeks to reduce its environmental footprint.

Environmental considerations are increasingly shaping the market dynamics of synthetic lubricants. The industry is responding to environmental concerns by developing lubricants with lower environmental impact, reduced toxicity, and improved biodegradability. The shift towards eco-friendly lubricants is particularly evident in applications where environmental regulations are stringent, such as in the marine and industrial sectors.

Market dynamics are further influenced by the competitive landscape within the synthetic lubricant industry. The presence of multinational corporations, specialized lubricant manufacturers, and niche suppliers fosters competition. Companies vie for market share through investments in research and development, strategic partnerships, and the development of specialized synthetic lubricants tailored to meet the evolving needs of different industries. The level of competition often influences pricing strategies, with an emphasis on providing high-quality synthetic lubricants that offer superior performance benefits.

Consumer preferences and trends in end-use industries also impact the market dynamics of synthetic lubricants. As consumers and industries prioritize sustainability, energy efficiency, and equipment longevity, the demand for synthetic lubricants is expected to grow. The automotive and industrial sectors, in particular, are witnessing increased adoption of synthetic lubricants to meet these preferences and achieve operational efficiency.

Global economic conditions and macroeconomic factors contribute to the overall market dynamics of synthetic lubricants. Economic growth, industrial production, and global trade influence the demand for lubricants in various sectors. Additionally, currency fluctuations, trade policies, and geopolitical events can impact the pricing and availability of raw materials, further influencing market dynamics.

Leave a Comment