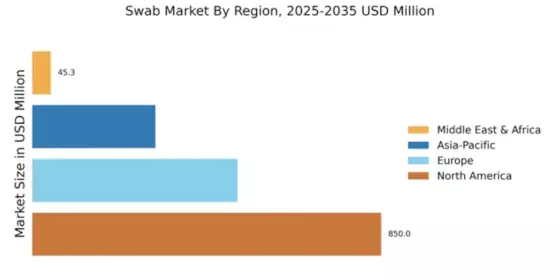

North America : Market Leader in Swab Production

North America is poised to maintain its leadership in the swab market, holding a significant share of 850.0M in 2025. The region's growth is driven by increasing healthcare expenditures, a rise in diagnostic testing, and stringent regulatory frameworks that ensure product quality and safety. The demand for swabs is further fueled by the ongoing need for COVID-19 testing and other infectious disease diagnostics, making it a critical component of public health strategies.

The competitive landscape in North America is robust, featuring key players such as Thermo Fisher Scientific, BD, and Abbott Laboratories. These companies are investing heavily in R&D to innovate and expand their product offerings. The presence of advanced healthcare infrastructure and a high level of awareness regarding hygiene and infection control also contribute to the region's market strength. As a result, North America is expected to continue leading The Swab well into the future.

Europe : Emerging Market with Growth Potential

Europe's swab market is projected to reach 500.0M by 2025, driven by increasing demand for diagnostic testing and a growing focus on healthcare quality. Regulatory bodies are enhancing guidelines to ensure the safety and efficacy of medical devices, which is expected to further stimulate market growth. The rise in chronic diseases and the need for rapid testing solutions are also key factors contributing to the market's expansion in this region.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, supported by established healthcare systems and significant investments in medical technology. Major players like Merck KGaA and F. Hoffmann-La Roche are actively involved in the market, focusing on innovation and strategic partnerships. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for a share of this lucrative market.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region is witnessing rapid growth in the swab market, projected to reach 300.0M by 2025. This growth is primarily driven by increasing healthcare access, rising awareness of hygiene, and the expansion of diagnostic services. Governments are investing in healthcare infrastructure and promoting initiatives to improve public health, which is expected to further boost demand for swabs in various applications, including COVID-19 testing and other infectious diseases.

Countries like China, India, and Japan are leading the charge in this market, supported by a growing population and increasing healthcare spending. The competitive landscape features both local and international players, including Qiagen N.V. and Eppendorf AG, who are focusing on expanding their market presence through innovative product offerings and strategic collaborations. The region's diverse healthcare needs present significant opportunities for growth in the swab market.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region is gradually emerging in the swab market, with a projected size of 45.26M by 2025. The growth is driven by increasing healthcare investments and a rising demand for diagnostic testing. However, challenges such as limited healthcare infrastructure and regulatory hurdles may impede faster growth. Governments are focusing on improving healthcare access and quality, which is expected to create opportunities for market expansion in the coming years.

Countries like South Africa and the UAE are leading the market, supported by initiatives to enhance healthcare services. The competitive landscape includes both local manufacturers and international players, although the market remains fragmented. Companies like Medline Industries and Puritan Medical Products are working to establish a stronger presence in the region, focusing on quality and affordability to meet local needs.