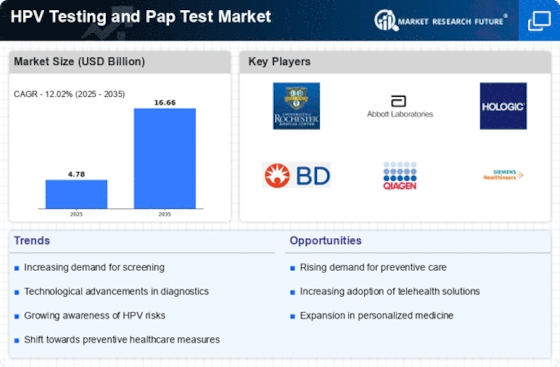

Growing Focus on Preventive Healthcare

The growing focus on preventive healthcare is a significant driver for the Hpv Testing Pap Test Market. As healthcare systems worldwide shift towards preventive measures, the importance of early detection through HPV testing and Pap tests is increasingly recognized. This paradigm shift is supported by healthcare professionals who advocate for regular screenings as a means to reduce the incidence of cervical cancer. Moreover, the rise of health-conscious consumers who prioritize preventive care is likely to boost demand for HPV testing services. Market data indicates that preventive healthcare spending is on the rise, which may lead to increased investments in HPV testing technologies and services. Consequently, this trend is expected to positively impact the Hpv Testing Pap Test Market.

Rising Incidence of HPV-Related Cancers

The increasing incidence of HPV-related cancers, particularly cervical cancer, is a critical driver for the Hpv Testing Pap Test Market. According to health statistics, cervical cancer remains one of the leading causes of cancer-related deaths among women. This alarming trend has prompted healthcare authorities to advocate for regular screening and testing. As awareness grows regarding the link between HPV and cancer, more individuals are likely to seek HPV testing and Pap tests. The World Health Organization has set ambitious targets for cervical cancer elimination, which further emphasizes the need for effective screening methods. Consequently, the demand for HPV testing and Pap tests is expected to rise, thereby propelling the Hpv Testing Pap Test Market forward.

Increased Public Awareness and Education

Increased public awareness and education regarding HPV and its associated risks are pivotal for the Hpv Testing Pap Test Market. Educational campaigns led by health organizations and non-profits have significantly improved knowledge about HPV transmission and its link to cervical cancer. As more individuals become informed about the importance of regular screenings, the demand for HPV testing and Pap tests is likely to rise. Surveys indicate that women who receive education about HPV are more inclined to participate in screening programs. This heightened awareness not only encourages proactive health behaviors but also fosters a culture of preventive care. As educational efforts continue to expand, they are expected to further stimulate growth within the Hpv Testing Pap Test Market.

Technological Innovations in Testing Methods

Technological innovations in testing methods are transforming the Hpv Testing Pap Test Market. Advances in molecular diagnostics and automation have improved the accuracy and efficiency of HPV testing and Pap tests. For example, the introduction of liquid-based cytology has enhanced the sensitivity of Pap tests, leading to better detection rates of precancerous lesions. Furthermore, the development of HPV genotyping tests allows for more precise risk assessment, which is crucial for patient management. As these technologies become more widely adopted, they are expected to drive market growth by increasing the reliability of testing and encouraging more women to participate in screening programs. The integration of these innovations into routine clinical practice is likely to reshape the landscape of the Hpv Testing Pap Test Market.

Government Initiatives and Screening Programs

Government initiatives aimed at increasing screening rates for cervical cancer significantly influence the Hpv Testing Pap Test Market. Many countries have implemented national screening programs that encourage women to undergo regular Pap tests and HPV testing. These initiatives often include public awareness campaigns that educate women about the importance of early detection and prevention. For instance, some regions have reported a 30% increase in screening rates following the introduction of such programs. Additionally, funding for these initiatives often leads to subsidized testing, making it more accessible to a broader population. As governments continue to prioritize women's health, the Hpv Testing Pap Test Market is likely to experience sustained growth.