Expansion of Aerospace Applications

The aerospace industry is experiencing a significant transformation, with super engineering plastics playing a crucial role in the development of lightweight and high-performance components. The super engineering plastics market is witnessing increased demand for materials that can withstand extreme temperatures and pressures, such as polyetherimide (PEI) and polyamide-imide (PAI). Market data suggests that the aerospace sector's demand for these materials is projected to grow by approximately 8% annually over the next few years. This growth is driven by the need for fuel-efficient aircraft and the desire to reduce overall weight without compromising safety. As aerospace manufacturers continue to innovate, the super engineering plastics market is likely to expand, providing essential materials for the next generation of aircraft.

Rising Focus on Renewable Energy Solutions

The shift towards renewable energy solutions is creating new opportunities for the super engineering plastics market. As the world moves towards sustainable energy sources, materials that can withstand extreme conditions and provide durability are in high demand. Super engineering plastics, such as fluoropolymers and polyimides, are being increasingly used in applications like wind turbine components and solar panel manufacturing. Market projections indicate that the renewable energy sector could drive a growth rate of approximately 12% for super engineering plastics by 2027. This trend underscores the importance of these materials in supporting the transition to cleaner energy solutions, positioning the super engineering plastics market as a key player in the sustainability movement.

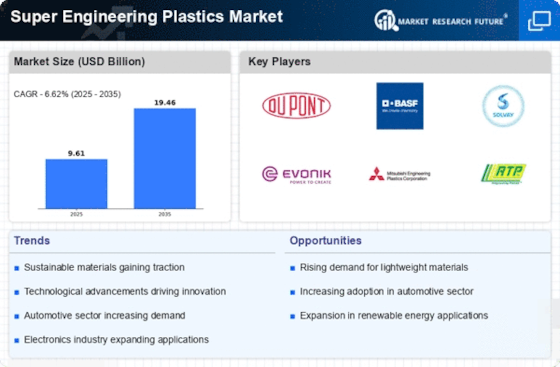

Increasing Applications in Automotive Sector

The automotive sector is witnessing a notable shift towards the adoption of super engineering plastics, driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions. Super engineering plastics market is experiencing a surge in demand as manufacturers seek alternatives to traditional materials. For instance, the use of polyamide and polycarbonate in automotive components is projected to grow significantly, with estimates suggesting a market value increase of approximately 15% by 2026. This trend is further supported by stringent regulations aimed at reducing carbon footprints, compelling automotive manufacturers to innovate and incorporate advanced materials. Consequently, the super engineering plastics market is poised for substantial growth as it aligns with the automotive sector's sustainability goals.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are playing a pivotal role in shaping the super engineering plastics market. Innovations such as 3D printing and advanced injection molding techniques are enabling the production of complex geometries and customized solutions. These technologies not only enhance the efficiency of production but also reduce waste, thereby appealing to environmentally conscious consumers. The market data indicates that the adoption of these technologies could lead to a reduction in production costs by up to 20%, making super engineering plastics more accessible to various industries. As manufacturers continue to invest in these innovations, the super engineering plastics market is likely to expand, catering to diverse applications across sectors.

Growing Demand from Electronics and Electrical Industries

The electronics and electrical industries are increasingly turning to super engineering plastics for their superior thermal and electrical insulation properties. The super engineering plastics market is benefiting from this trend, as materials like polyphenylene sulfide (PPS) and polyether ether ketone (PEEK) are being utilized in components such as connectors, housings, and circuit boards. Market analysis suggests that the demand for these materials is expected to grow at a compound annual growth rate of around 10% over the next five years. This growth is driven by the need for lightweight, durable, and high-performance materials that can withstand harsh operating conditions. As a result, the super engineering plastics market is likely to see increased investments and innovations tailored to meet the specific needs of the electronics sector.