Focus on Energy Efficiency

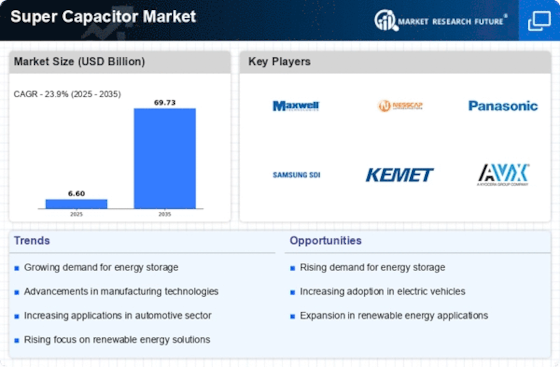

The Super Capacitor Industry forward. Governments and organizations are increasingly implementing regulations and incentives aimed at reducing energy consumption and carbon emissions. Super capacitors, with their ability to store and release energy efficiently, align well with these objectives. The market for energy-efficient technologies is projected to grow significantly, with investments in energy-saving solutions expected to reach USD 500 billion by 2025. This focus on sustainability suggests that the Super Capacitor Market will likely see increased adoption across various sectors, including industrial and commercial applications.

Integration with Smart Grids

The integration of super capacitors into smart grid systems appears to be a pivotal driver for the Super Capacitor Market. As energy demands fluctuate, super capacitors provide rapid energy storage and discharge capabilities, which are essential for maintaining grid stability. The increasing investment in smart grid technologies, projected to reach USD 100 billion by 2026, indicates a growing reliance on energy storage solutions. Super capacitors can enhance the efficiency of energy distribution and reduce transmission losses, thereby supporting the transition to more sustainable energy systems. This trend suggests that the Super Capacitor Market will likely experience substantial growth as utilities seek to optimize their operations and incorporate renewable energy sources.

Growth in Consumer Electronics

The consumer electronics sector is witnessing a surge in the adoption of super capacitors, which are favored for their compact size and high power density. The Super Capacitor Market is expected to expand as devices such as smartphones, tablets, and wearables increasingly require efficient energy storage solutions. With The Super Capacitor projected to reach USD 1 trillion by 2026, the demand for super capacitors is likely to rise in tandem. Their ability to provide rapid charging and discharging capabilities makes them ideal for applications where space and weight are critical. This trend indicates a robust growth trajectory for the Super Capacitor Market in the coming years.

Rising Demand for Electric Vehicles

The burgeoning electric vehicle (EV) market is driving the demand for super capacitors, which are increasingly recognized for their ability to provide quick bursts of energy. The Super Capacitor Market is likely to benefit from the projected increase in EV sales, which are expected to surpass 30 million units annually by 2030. Super capacitors can complement traditional batteries by enhancing acceleration and regenerative braking systems, thus improving overall vehicle performance. This synergy between super capacitors and EV technology suggests a promising future for the Super Capacitor Market, as manufacturers seek to develop more efficient and powerful energy storage solutions.

Technological Advancements in Energy Storage

Technological advancements in energy storage solutions are significantly influencing the Super Capacitor Market. Innovations in materials and manufacturing processes are enhancing the performance and reducing the costs of super capacitors. Research indicates that the energy density of super capacitors could improve by 30% over the next few years, making them more competitive with traditional battery technologies. As industries seek to adopt more efficient energy storage systems, the Super Capacitor Market is poised for growth. The ongoing development of hybrid systems that combine super capacitors with batteries further indicates a trend towards more versatile energy storage solutions.