Diverse End-Use Industries

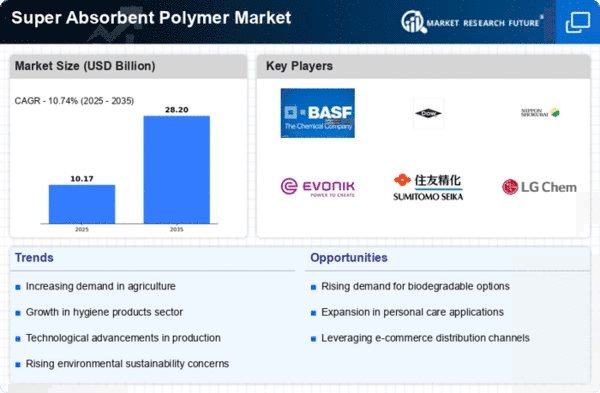

The Global Super Absorbent Polymer Market Industry benefits from its diverse applications across various end-use industries, including healthcare, agriculture, and consumer goods. This versatility allows for a broad customer base and mitigates risks associated with reliance on a single sector. For instance, in healthcare, super absorbent polymers are essential in wound care products, while in agriculture, they enhance soil moisture retention. The anticipated compound annual growth rate of 10.74% from 2025 to 2035 indicates a robust market outlook, driven by the continuous exploration of new applications and the adaptation of existing products to meet specific industry needs.

Growing Environmental Concerns

The Global Super Absorbent Polymer Market Industry is increasingly shaped by growing environmental concerns and the push for sustainable materials. Consumers and manufacturers alike are becoming more aware of the environmental impact of traditional materials, leading to a shift towards biodegradable and eco-friendly super absorbent polymers. This trend is particularly relevant as regulatory bodies implement stricter guidelines on plastic usage and waste management. The market's potential to reach 28.2 USD Billion by 2035 underscores the importance of sustainability in driving innovation and product development. Companies that prioritize eco-friendly solutions may find themselves at a competitive advantage in this evolving landscape.

Rising Demand in Hygiene Products

The Global Super Absorbent Polymer Market Industry experiences a notable surge in demand driven by the increasing consumption of hygiene products such as diapers and feminine hygiene items. The growing awareness of personal hygiene, particularly in developing regions, contributes to this trend. For instance, the market is projected to reach 9.18 USD Billion in 2024, reflecting a robust growth trajectory. As urbanization progresses and disposable income rises, consumers are likely to prioritize hygiene, further propelling the demand for super absorbent polymers. This trend indicates a potential for sustained growth in the industry as manufacturers innovate to meet evolving consumer preferences.

Agricultural Applications Expansion

The Global Super Absorbent Polymer Market Industry is witnessing an expansion in agricultural applications, particularly in water retention and soil management. Super absorbent polymers are increasingly utilized in agricultural practices to enhance soil moisture retention, thereby improving crop yields. This is particularly relevant in regions facing water scarcity, where efficient water usage is paramount. The incorporation of these polymers can lead to a reduction in irrigation frequency, which is crucial for sustainable farming. As the global population continues to grow, the demand for food production intensifies, suggesting that the agricultural sector will increasingly rely on super absorbent polymers to optimize resource use.

Technological Advancements in Production

Technological advancements in the production of super absorbent polymers are significantly influencing the Global Super Absorbent Polymer Market Industry. Innovations in manufacturing processes enhance the efficiency and effectiveness of these materials, leading to improved performance characteristics. For example, the development of new polymerization techniques allows for the creation of super absorbent polymers with superior absorption capacities and faster absorption rates. This not only meets the diverse needs of various applications but also positions manufacturers competitively in the market. As these technologies evolve, they are likely to drive down production costs, thereby expanding the market further.