Stringent Regulatory Frameworks

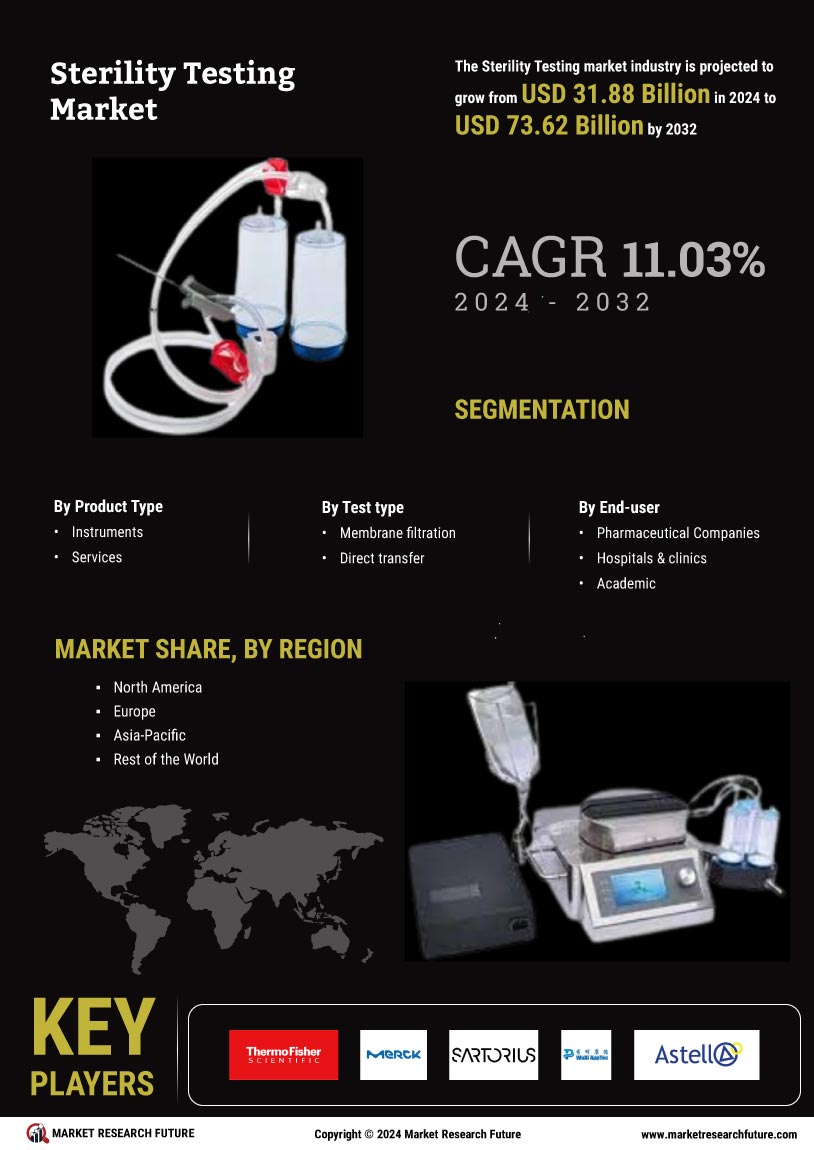

The Sterility Testing Market is significantly influenced by stringent regulatory frameworks imposed by health authorities. Regulatory bodies, such as the FDA and EMA, mandate comprehensive sterility testing for pharmaceutical and medical device products. These regulations ensure that products meet safety standards, thereby fostering consumer trust. In 2025, the enforcement of these regulations is expected to intensify, compelling manufacturers to invest in advanced sterility testing technologies. This regulatory landscape not only drives compliance but also stimulates innovation within the Sterility Testing Market, as companies seek to develop more efficient and reliable testing methods to adhere to evolving standards.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a pivotal driver for the Sterility Testing Market. As the biopharmaceutical sector expands, the need for rigorous sterility testing becomes paramount to ensure product safety and efficacy. In 2025, the biopharmaceutical market is projected to reach approximately 500 billion USD, necessitating stringent sterility testing protocols. This surge in demand compels manufacturers to adopt advanced sterility testing methods, thereby propelling the growth of the Sterility Testing Market. Furthermore, the rise in chronic diseases and the aging population contribute to the growing biopharmaceutical sector, further emphasizing the importance of sterility testing in maintaining product integrity and consumer safety.

Increasing Focus on Quality Assurance

The emphasis on quality assurance in the pharmaceutical and biotechnology sectors is a key driver for the Sterility Testing Market. Companies are increasingly prioritizing quality control measures to ensure product safety and compliance with regulatory standards. In 2025, The Sterility Testing Market is projected to reach over 100 billion USD, highlighting the critical role of sterility testing in maintaining product integrity. This focus on quality assurance not only enhances consumer confidence but also drives investments in advanced sterility testing solutions. As organizations strive to uphold high-quality standards, the Sterility Testing Market is expected to experience robust growth.

Expansion of Healthcare Infrastructure

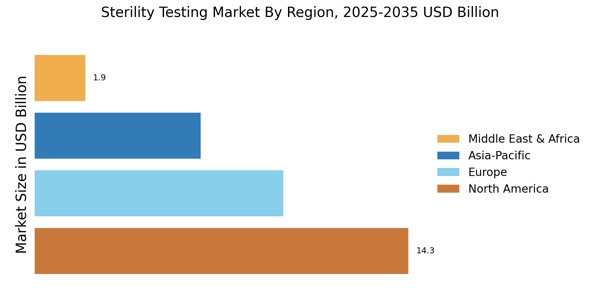

The expansion of healthcare infrastructure is a significant factor influencing the Sterility Testing Market. As healthcare facilities grow and evolve, the demand for sterile products and medical devices increases correspondingly. In 2025, investments in healthcare infrastructure are projected to rise, particularly in emerging markets, leading to a heightened need for effective sterility testing. This expansion necessitates the implementation of stringent sterility testing protocols to ensure the safety of medical products. Consequently, the Sterility Testing Market is likely to benefit from this trend, as healthcare providers seek reliable testing solutions to meet the demands of an expanding patient population.

Technological Innovations in Testing Methods

Technological innovations play a crucial role in shaping the Sterility Testing Market. The advent of automated testing systems and rapid microbial detection technologies enhances the efficiency and accuracy of sterility testing. In 2025, the market for automated sterility testing solutions is anticipated to grow significantly, driven by the need for faster results and reduced human error. These advancements not only streamline testing processes but also reduce operational costs for manufacturers. As companies increasingly adopt these innovative technologies, the Sterility Testing Market is likely to witness substantial growth, reflecting the ongoing evolution of testing methodologies.