Surge in Demand for Embedded Systems

The proliferation of embedded systems across various industries is significantly influencing the Static Random-Access Memory (SRAM) Market. Embedded systems, which are integral to devices such as smart appliances, automotive electronics, and industrial automation, require reliable and efficient memory solutions. SRAM is often preferred in these applications due to its ability to provide quick access to data without the need for refresh cycles, unlike dynamic RAM. The embedded systems market is expected to reach a valuation of over 1 trillion USD by 2026, indicating a robust growth trajectory. This surge in demand for embedded systems is likely to drive the adoption of SRAM, as manufacturers seek to enhance the performance and reliability of their products.

Rising Adoption of Consumer Electronics

The rising adoption of consumer electronics is a significant driver for the Static Random-Access Memory (SRAM) Market. As consumers increasingly demand advanced features in devices such as smartphones, tablets, and gaming consoles, the need for high-performance memory solutions becomes critical. SRAM is often employed in cache memory for processors, enhancing the speed and efficiency of these devices. The consumer electronics market is projected to grow at a compound annual growth rate of around 6% from 2023 to 2028, reflecting the increasing consumer preference for high-quality electronic products. This trend is likely to boost the demand for SRAM, as manufacturers strive to meet consumer expectations for faster and more responsive devices.

Expansion of Telecommunications Infrastructure

The ongoing expansion of telecommunications infrastructure is a crucial driver for the Static Random-Access Memory (SRAM) Market. With the advent of 5G technology and the increasing need for faster and more reliable communication networks, SRAM plays a vital role in network equipment and devices. The telecommunications sector is projected to invest heavily in upgrading infrastructure, with estimates suggesting investments could exceed 1 trillion USD by 2025. This investment is expected to create a substantial demand for SRAM, as it is essential for managing high-speed data transmission and processing. As telecommunications companies strive to enhance their service offerings, the reliance on SRAM is likely to grow, further propelling the market.

Growth in Artificial Intelligence Applications

The rise of artificial intelligence (AI) applications is significantly impacting the Static Random-Access Memory (SRAM) Market. AI technologies require substantial computational power and fast memory access to process large datasets efficiently. SRAM, with its high speed and low latency, is increasingly utilized in AI hardware, including neural networks and machine learning systems. The AI market is anticipated to reach a valuation of approximately 500 billion USD by 2024, indicating a robust growth potential. This growth is likely to drive the demand for SRAM, as companies seek to optimize their AI systems for better performance. The integration of SRAM in AI applications is expected to enhance processing capabilities, thereby fostering further advancements in the field.

Increasing Need for High-Speed Data Processing

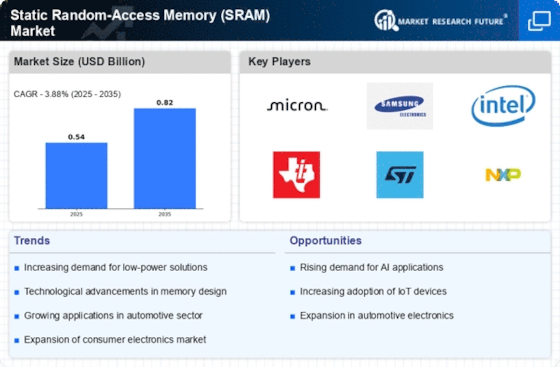

The demand for high-speed data processing is a primary driver in the Static Random-Access Memory (SRAM) Market. As applications in sectors such as telecommunications and computing evolve, the necessity for faster data retrieval and processing speeds becomes paramount. SRAM, known for its low latency and high speed, is increasingly favored in high-performance computing environments. The market for SRAM is projected to grow at a compound annual growth rate of approximately 5.2% from 2023 to 2028, reflecting the rising need for efficient data handling. This trend is particularly evident in data centers and cloud computing services, where the performance of SRAM can significantly enhance overall system efficiency. Consequently, the increasing need for high-speed data processing is likely to propel the SRAM market forward.