Growth in Packaging Applications

The packaging industry is increasingly recognizing the importance of anti-static films, particularly for the safe packaging of electronic goods. The Global Anti-Static Films Market is likely to benefit from this trend, as anti-static films provide essential protection against static electricity during transportation and storage. In recent years, the demand for anti-static packaging solutions has escalated, with the market projected to expand significantly. This growth is attributed to the rising need for secure packaging solutions that ensure the integrity of sensitive electronic products, thereby enhancing the overall market landscape for anti-static films.

Increasing Awareness of ESD Risks

There is a growing awareness of the risks associated with electrostatic discharge (ESD) across various industries, which is positively influencing the Global Anti-Static Films Market. As organizations recognize the potential damage that ESD can cause to electronic components, the demand for protective solutions, including anti-static films, is on the rise. This heightened awareness is prompting companies to implement stringent measures to mitigate ESD risks, thereby driving the adoption of anti-static films. The market is likely to see continued growth as more industries prioritize ESD protection in their operations.

Expansion of E-Commerce and Logistics

The rapid expansion of e-commerce and logistics sectors is contributing to the growth of the Global Anti-Static Films Market. As online shopping continues to gain traction, the need for effective packaging solutions that protect electronic products during transit becomes increasingly critical. Anti-static films play a vital role in safeguarding these products from electrostatic discharge, which can lead to damage. The logistics sector's emphasis on efficient and secure packaging solutions is likely to drive the demand for anti-static films, indicating a positive outlook for the market in the coming years.

Rising Demand from Electronics Sector

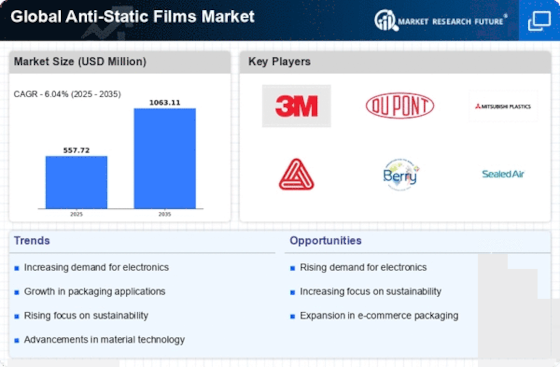

The electronics sector is experiencing a notable surge in demand for anti-static films, primarily due to the increasing production of sensitive electronic components. As manufacturers strive to protect these components from electrostatic discharge, the Global Anti-Static Films Market is witnessing a corresponding rise in the adoption of anti-static films. In 2025, the electronics industry is projected to account for a substantial share of the market, driven by the proliferation of consumer electronics and advancements in semiconductor technology. This trend suggests that the need for effective protective solutions will continue to grow, thereby bolstering the market for anti-static films.

Technological Innovations in Film Production

Technological innovations in the production of anti-static films are enhancing their performance and expanding their applications. The Global Anti-Static Films Market is benefiting from advancements in materials science, which are leading to the development of films with superior anti-static properties. These innovations not only improve the effectiveness of the films but also allow for customization to meet specific industry needs. As manufacturers continue to invest in research and development, the market is expected to witness a proliferation of advanced anti-static film products, further driving growth.